Advanced Motor Fuels in Finland

Drivers and Policies

Finland’s 2016 energy and climate strategy calls for a 50% reduction in carbon dioxide (CO2) emissions from transport by 2030 (from reference year 2005).[1] The 2019 Government Programme sets a new upper level: Finland will achieve carbon neutrality by 2035 and aims to be the world’s first fossil-free welfare society. Currently, Finland is encountering huge challenges to meeting this target because the carbon sinks in the forests and soil have been included in the calculation. During the last few years, forests have turned from carbon sinks to net carbon sources. At the time that the Finnish climate law was established, forests were acting as carbon sinks, providing a favourable outlook for reducing GHG emissions.

In May 2021, the Ministry of Transport and Communications of Finland published a roadmap for fossil-free transport, with the goal of halving greenhouse gas (GHG) emissions from transport by 2030, (using 2005 as the base year) and achieving zero emissions by 2045. Roadmap measures include actions to support the procurement of electric and gas-powered vehicles and enhancements to distribution infrastructure, pedestrian and bicycle traffic, and public transport. In addition, the roadmap covers the impacts of a stricter obligation to distribute renewable fuels, as well as the impacts of remote work, new transport services, and combined transports in freight traffic.[2]

In spring 2019, the biofuels obligation was revised and Finland’s pathway toward 2030 was set. The biofuel target for 2029 and beyond was set at 30%, and this time, the target reflects actual energy contributions without double counting, which explains the lower obligation for 2021 compared with 2020 (20%). A separate sub target for advanced biofuels was also established, following the European Union (EU) Renewable Energy Directive (RED II): 2% between 2021 and 2023. In 2021, Finland passed a law amending gaseous and liquefied biogas in the transport biofuels obligation beginning January 1, 2022, and a law amending electro-fuels in the biofuels obligation beginning January 1, 2023.[3],[4] In September 2022, the government proposed that Parliament increase the renewable fuels blending obligation to 34% in 2030 and onward.[5] The original biofuels obligation (liquid biofuels) calls for 19.5% biofuels for on-road transportation in 2022. However, due to a sudden increase in fuel prices during the spring of 2022, the government decided to reduce the blending obligation by 7.5%, to 12% for 2022 and to 13.5% for 2023. In October 2023, the government of Finland proposed that Parliament reduce the biofuels obligation from 28% to 13.5% also for 2024,[6] which was then approved. The reason for the reduction was an estimated 17-cent increase in diesel and 15-cent increase per liter in gasoline prices that would result from a 28% biofuels obligation. The current blending obligation[7] calls for 16.5% for 2025 and 19.5% for 2026. In 2030, the regulation still calls for a 34% biofuel share.

A separate renewable fuels obligation was established for non-road machinery diesel fuels. With the current level at 6%, the original law called for an annual increase of up to 10% in 2030. In November 2022, the government proposed that Parliament increase the renewable fuels blending obligation in non-road machinery use to 30% in 2030 and onward.[8] However, this proposal was not accepted.

As of 2011, the fuel tax system consists of an energy component, a CO2 component, and a bonus for reduced local emissions. The system favours the best biofuels, but it is still transparent and technology-neutral and can be used in combination with the obligation for liquid biofuels. Passenger car taxation (purchase tax and annual tax) has been CO2-based (tailpipe) since 2008, providing substantial incentives for battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).[9] In addition, since 2020, Finland has offered a reduced-tax benefit for citizens who drive a company-owned car. The value has been 170€ annually for BEVs and 85€ annually for cars with CO2 emissions in the range of 1–100 g/km. The benefit will end at the end of 2025.

The current government programme promotes the use of renewable fuels via fuel conversion kits. The government has also proposed national legislation modifications for promoting flexi-fuel (85% ethanol in gasoline [E85]) and biomethane passenger car conversion kit installations.[10] However, the proposal leaves open the details regarding how motorists with converted cars can demonstrate compliance with safety and emissions requirements.

Advanced Motor Fuels Statistics

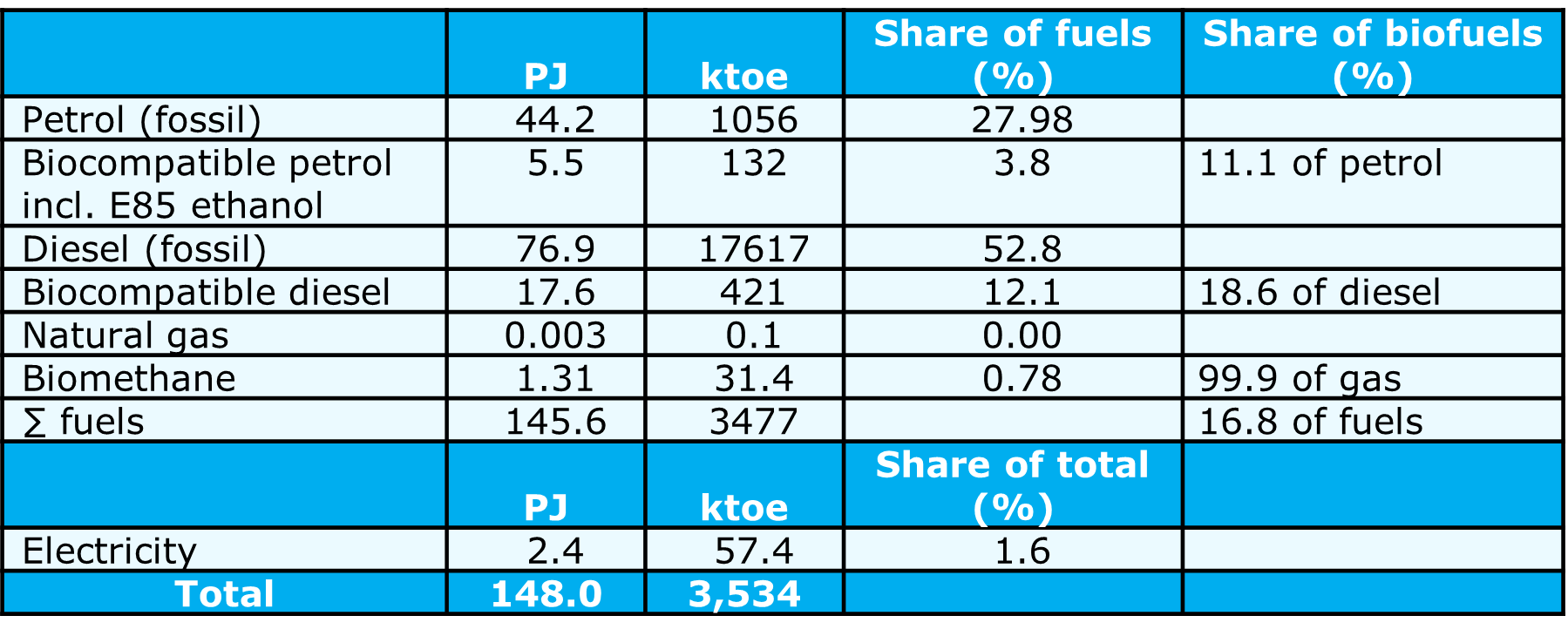

In 2023, the energy consumption in domestic transport (all modes together) was 161 petajoules (PJ), and energy consumption in road transport was 148 PJ, or 3533 kilo tonnes of oil equivalent (toe) (Table 1). Relative to Finland’s total energy consumption of 1,317 PJ in 2023, the transport consumption figures were 12.2% (total) and 11.2% (road), respectively.[11]

Table 1. Energy in Road Transport, 2023[12]

In terms of energy, the contribution of biofuels relative to the total fuel consumption in road transport is 16.8%, ranging from 11.1% in petrol (mostly ethanol and some ethyl tertiary-butyl ether [ETBE], but also bio-naphtha; the statistics do not include details on this) to 99.9% in methane. The actual amount was 565 ktoe, or 16.8% of the fuels.

The four major Finnish players in biofuels are Neste (the world’s biggest producer of hydrotreated vegetable oil [HVO]), UPM, St1, and Gasum.

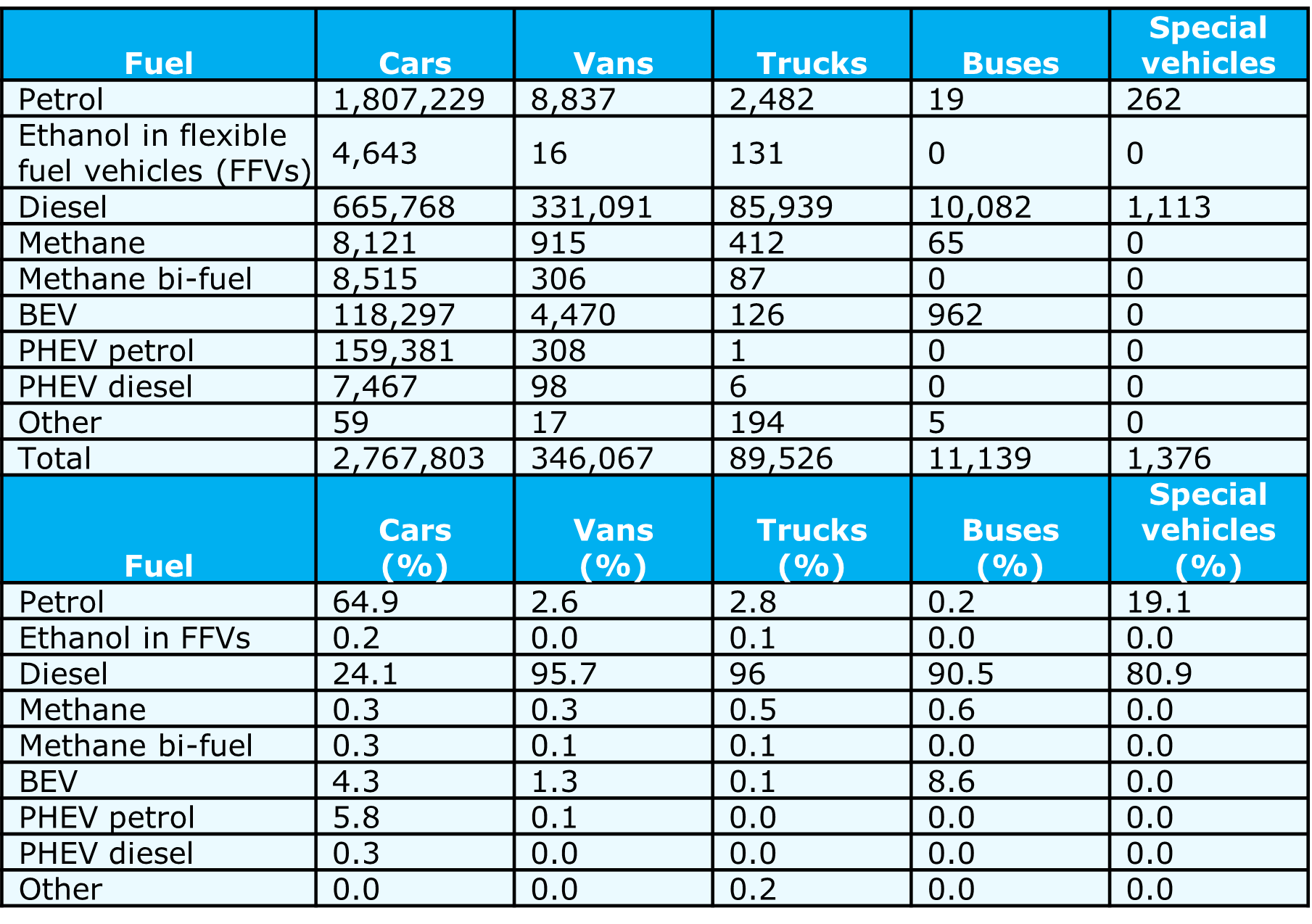

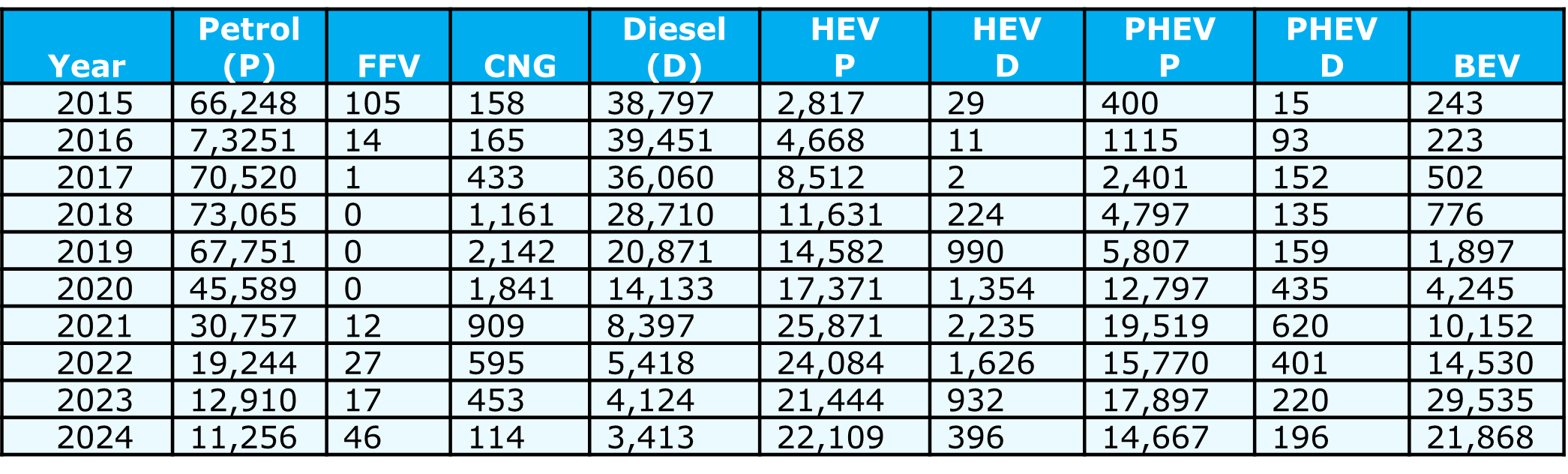

Table 2 presents the vehicle fleet in use at the end of 2024 (without two- and three-wheelers and light four-wheelers). Table 3 lists the sales figures for new passenger cars in 2015–2024 (revised).

Table 2. Vehicle Fleet in Use at the End of 2024 (without two- and three-wheelers and light four-wheelers)[13]

Table 3. First Registration of New Passenger Cars, 2015–2024[14]

In 2024, only 74,072 new cars were sold — approximately 15% less than in 2023. Fewer cars were sold only during 1992–1994. Diesel shares of new sales continue to decline and in 2024 represented only 4.6%, compared with 35.7% in 2015. Sales of PHEVs remained at around 20.1% of total new sales. BEVs are becoming more popular, and sales have increased year over year. In 2024, BEVs represented about 29.5% of total new sales.

Finland has an estimated 829 alternative-fueled trucks, including FFVs and bi-fuel vehicles. Methane-fueled trucks represent the greatest share. The numbers for these two categories are explained by the fact that some heavy pickup trucks and vans are registered as trucks. With the development of liquefied natural gas (LNG) refueling infrastructure and increased offerings of heavy gas trucks, trucks fueled by LNG now operate on Finnish roads. The number of trucks fueled by compressed natural gas (CNG) and LNG grew to 412 in 2024. The number of battery electric buses has surpassed the number of CNG buses. The increase in electric (city) buses has been rapid. In 2020, Finland had a total of 87 electric buses and in 2024, the nation had 962.

Research and Demonstration Focus

The following paragraphs describe some national Business Finland funded research and development (R&D) projects, in which the VTT Technical Research Centre of Finland (VTT) is taking part.

The E-Fuel project (2021–2024) focused on integration of hydrogen production through high-temperature electrolysis with CO2 sequestration and Fischer-Tropsch fuel synthesis. Electrofuel developed from green hydrogen and CO2 was demonstrated in an agricultural tractor in 2023.[15]

he BIOFLEX project (2020–2024), explored the suitability of fuel oils made from biomass and waste plastics for power plants and marine diesel engines. The project team studied the development of production processes and measured emissions when using new biofuels in marine engines.

The Clean Propulsion Project (2021–2024), focused on developing maritime and non-road engine technologies that run efficiently on renewable fuels. The project had four focus areas:

- Developing a roadmap for sustainable shipping.

- Investigating and developing multiple power source propulsion systems, including hybrid technology demonstration.

- Formulating novel combustion concepts and exhaust gas after-treatment technologies that achieve close to zero emissions. This focus area includes investigation of different fuel options, including hydrogen in non-road applications.

- Developing a virtual sensor and control algorithm for increased powertrain efficiency and full deployment of renewable fuels.

The NoDamageTruck project (2022–2025), focuses on developing an electrically assisted trailer axle for heavy-duty vehicles to improve the energy efficiency of internal combustion engine (ICE)-powered vehicles and improve work productivity. The focus is on typical Nordic countries’ vehicle applications (i.e., vehicles with a gross weight up to 76 tonnes). The project includes formulating a flexible and rapid design methodology for combining model-based development with experimental testing activities to accelerate the overall development process. The project also includes a simulation-based evaluation of the potential of e-axles in different heavy-duty vehicle (HDV) applications, such as timber, long-haul, and rock transport. The e-axle concept will be demonstrated on an experimental basis.

The DeCARBO project (2022–2025), funded by Business Finland, investigates the most suitable technologies for decarbonization of non-road mobile machinery (NRMM) in mining, harbour, and forestry use cases. The project consists of four focus areas.

- Foresight and scenario investigation that allows researchers to offer guidance on possible future development paths.

- Research on the most promising potential technological solutions for decarbonization of NRMM in different use cases and operational environments. In particular, the study looks at different options for off-grid-environment NRMM applications.

- Hydrogen fuel-cell and renewable fuel ICE power generation options for off-grid power generation needs.

- Techno-economic analyses to evaluate not only technical attributes but also economic feasibility.

The Clean Propulsion Project, completed between 2021–2024, followed by the Flexible Clean Propulsion Project (2024-2027),[16] which continues to investigate new fuel and combustion alternatives for marine and off-road solutions. The project comprises topics such as

- Multi-fuel combustion for medium-speed applications.

- Multi-fuel combustion for high-speed applications.

- Regulations and feasibility of multi-fuel combos.

- Aftertreatment technologies for multi-fuel engines.

The iHAPC (Integrated Hydrogen-Argon Power Cycle) project (2025–2027), funded by Business Finland, focuses on research to achieve full valorisation of green hydrogen (H2) with unprecedented power generation efficiency. The concept offers a step-change for well-established and robust combustion engine technology, by substituting air with a monoatomic gas, argon. The project aims to bring H-APC to technology readiness level 6 (TRL-6) by demonstrating sustainable operation with at least 65% efficiency on a 150-kW single-cylinder engine.

VTT participates in several EU-funded projects related to advanced motor fuels, such as GREEN RAY (2022-2027), which aims at minimizing methane slip from LNG vessels; APOLLO (2023-2025), which demonstrates the use of ammonia as fuel in an offshore supply vessel, REFOLUTION (2023-2026), which aims to demonstrate the cost-effective production of advanced biofuels for aviation and marine sector, and PAREMPI (2023-2025) on particle emission prevention and impact; covering pathway from real-world emissions of traffic to secondary PM of urban air.

Outlook

Finland must reduce its CO2 in the non-ETS (not part of the EU Emissions Trading Scheme) sector by 39% by 2030, putting pressure on emission reductions in transport. Biofuels — or, in more general terms, renewable fuels — are seen as a particularly important element of emissions reductions in transport. With its new liquid biofuels mandate written into law in spring 2019, Finland is one of the few countries with a fixed biofuels policy articulated through 2030. In parallel with increasing the amount of biofuels, Finland is promoting energy efficiency and electrification in transport as well.

In 2022, green hydrogen and e-fuels production advanced as many new investment plans were published. In total, the plans described capacity goals of more than 1 GW for green hydrogen and more than 500 MW for green methane production. In addition, there were investment plans for green ammonia production, and the nation plans to target green methane to support green fuels use in HDVs. During 2023, new investment plans were published. Thus far, implementation of only few of the plans introduced since 2022 has progressed to construction of the plants.

The very first industrial-scale hydrogen production plant will begin operation during the first half of 2025. The plant has a capacity of 20 MW of power for electrolyses.

Major changes

Finland’s energy and climate strategy calls for a 50% reduction in CO2 emissions from transport by 2030 and a new upper-level target for the country to be CO2-neutral by 2035. A renewable fuel (including liquids and biomethane) law for road transport calls for an actual energy share of 34% renewable fuels by 2030. A separate sub-target of 10% was set for advanced biofuels. In addition, the law for non-road machinery fuels calls for a 10% share of renewable fuels beginning in 2030. This legislation signals that Finland is implementing one of the world’s most progressive biofuels policies. In addition, the government emphasizes a circular economy and the development of biogas. Despite the significant increase in wind electricity production, the majority of announced plans for green hydrogen production have not yet progressed into implementation.

[1] Ministry of Economic Affairs and Employment of Finland, “Energy and Climate Strategy,” https://tem.fi/en/energy-and-climate-strategy-2016

[2] Ministry of Transport and Communications, “Transport emissions can be halved by 2030 through national and EU measures,” https://www.lvm.fi/en/-/transport-emissions-can-be-halved-by-2030-through-national-and-eu-measures-1641099.

[3] EdiLex, “Obligation to distribute biofuels,” https://www.edilex.fi/verohallinnon_ohjeet/2020_1116.html

[4] Ministry of Economic Affairs and Employment of Finland, “Working Life Barometer 2023: More support for continuous learning needed at workplaces,” https://tem.fi/-/biopolttoaineet-jakeluvelvoitteeseen.

[5] Parliament of Finland, “Government proposal HE 174 /2022 vp,” https://www.eduskunta.fi/FI/vaski/HallituksenEsitys/Sivut/HE_174+2022.aspx.

[6] Ministry of Economic Affairs and Employment of Finland, “Bill: Transportation fuel distribution obligation 13.5% also next year,” https://tem.fi/-/lakiesitys-liikennepolttoaineiden-jakeluvelvoite-13-5-myos-ensi-vuonna-.

[7] Law for deployment of renewable fuels in road transport. https://www.finlex.fi/fi/lainsaadanto/2007/446

[8] Parliament of Finland, “Government proposal HE 297 /2022 vp,” https://www.eduskunta.fi/FI/vaski/HallituksenEsitys/Sivut/HE_297+2022.aspx

[9] Parkkonen, L., 2013, “Taxation of petroleum products and vehicles in Finland,” CEN/TC 19 Conference. Helsinki, May 27, 2013.

[10] Finlex, “The government’s proposal to parliament as a law on amending the Vehicle Act and related laws,” https://www.finlex.fi/fi/esitykset/he/2022/20220291

[11] Tilastokeskus (Statistics Finland), “Energy consumption in Finland,” https://pxdata.stat.fi/PxWeb/pxweb/fi/StatFin/StatFin__ehk/statfin_ehk_pxt_12st.px/table/tableViewLayout1/

[12] Source: Tilastokeskus, “Energy supply and consumption – Energy consumption in transport, 1990–2023,” https://pxdata.stat.fi/PxWeb/pxweb/fi/StatFin/StatFin__ehk/statfin_ehk_pxt_12sz.px/table/tableViewLayout1/

[13] Tieto.Traficom, “Vehicle fleet statistics,” https://tieto.traficom.fi/fi/tilastot/ajoneuvokannan-tilastot?toggle=K%C3%A4ytt%C3%B6voimat

[14] Finnish Information Centre of Automobile Sector, “Motive power statistics of first registered passenger cars,”

https://www.aut.fi/tilastot/ensirekisteroinnit/ensirekisteroinnit_kayttovoimittain/henkiloautojen_kayttovoimatilastot.

[15] VTT, “Electrofuel developed from green hydrogen and carbon dioxide to be tested in practice for the first time,”

https://www.vttresearch.com/en/news-and-ideas/electrofuel-developed-green-hydrogen-and-carbon-dioxide-be-tested-practice-first.

[16] Clean Propulsion, “Flexible Clean Propulsion Technologies Project,” https://cleanpropulsion.org/