Advanced Motor Fuels in Austria

Drivers and Policies

Transport GHG Emissions Share and Increase

So far, Austria has only been able to report declining GHG emissions in the transport sector from the years 2005 to 2012. Since then, emissions have risen steadily due to the growing volume of traffic. Fuel consumption in the years 2020 through 2022 indicate lower emissions; however, this is most likely due to the pandemic and the high energy prices and not a first proof of a successful transition of the Austrian mobility system towards alternative drivetrains.

According to the Environmental Agency Austria, in 2020, the transport sector in Austria showed GHG emissions of approximately 20.7 million tonnes of CO2 equivalent. Compared to 2019, emissions decreased by 13.6%. This sharp decline was linked to the decline in passenger car mileage during the pandemic, which led to a drop in fuel demand.

In total, in 2020 biofuels substituted for around 6.08% of the fuels sold. This share exceeds the substitution target of 5.75% of fossil fuel on the market, as stipulated in the Fuel Ordinance; again, however, it represents a decline of 11% compared to the previous year. The relatively low sales volume of pure biofuels is due to the low competitiveness compared to fossil fuels. In 2020, the use of biofuels resulted in a reduction of approximately 1.33 million tonnes of CO2 emissions in the transport sector.

Politics: Recent Activities and Developments

Austria is committed to carbon neutrality by 2040 – a goal that requires substantially increased decarbonization efforts across all energy sectors. Especially in the transport sector, a radical turnaround is needed to contribute to the political target. For this reason Austria has adopted a number of measures, such as a newly designed taxation system that imposes a price on ecologically destructive activities. This system, enacted in 2021, introduces a CO2 pricing system with a continuously increasing price path from EUR 30 (USD 32.74) per ton CO2 (2022) up to EUR 55 (USD 60.02) per ton CO2 (2025). From 2026 onward, an EU-wide CO2 emissions trading system will replace national fixed price rates. In addition, an obligatory procurement of zero-emission vehicles by the public sector is taking effect. Other measures already in place are an increased Normverbrauchsabgabe (NoVA) tax and the “Right to Plug,” which alleviates previous approval hurdles for the installation of charging stations in multi-apartment buildings.

Austria has also developed a number of national strategies in the area of transport, such as the Mobility Master Plan and the corresponding RDI Mobility 2030 Strategy. Complementary strategic plans for freight transport and hydrogen also are near completion. Despite significant efforts, a consistent overarching activity document listing measures, their expected contributions, and corresponding KPIs (fully describing the path to climate neutrality in 2040) is not available. An updated Austrian National Energy and Climate Plan reflecting the ambitious European Green Deal targets in the Fit for 55 package (a 55% reduction of GHG emissions by 2030) might serve as the nucleus for an aggregation of all planned measures and an alignment of their expected impact contributions.

Austrian Integrated National Energy and Climate Plan (NECP)

The integrated NECP is a planning and monitoring instrument of the EU and its member states. It is intended to contribute to improved coordination of European energy and climate policy and serves as the central instrument for implementing the EU’s renewable energy and energy efficiency targets for 2030. For Austria, the NECP includes measures supporting the increase of the share of renewable energy sources in the transport sector, whereby in Austria the biogenic share in relation to the energy content of diesel is about 6.3%, and for petrol currently about 3.4%; and taxes such as the NoVA tax, in which a bonus/penalty system for CO2 emissions is levied when passenger cars are first placed on the domestic market (new car purchase or private import), which provides incentives to purchase vehicles with low CO2 emissions.

Taxes and Incentives

In July 2008, Austria introduced the NoVA tax for new vehicles. As of March 2014, new cars that emit less than 87 g of CO2/km are exempt from NoVA. Further reduction steps of 5g of CO2/km per year are planned until 2024. Each additional gram results in a financial penalty of EUR 80 (USD 87.30) on the purchase price of a passenger vehicle. Pure biofuels are exempt from the mineral oil tax. CNG is exempt from the mineral oil tax as well but is subject to the lower natural gas tax.

Advanced Motor Fuels Statistics

Fleet Distribution and Number of Vehicles in Austria

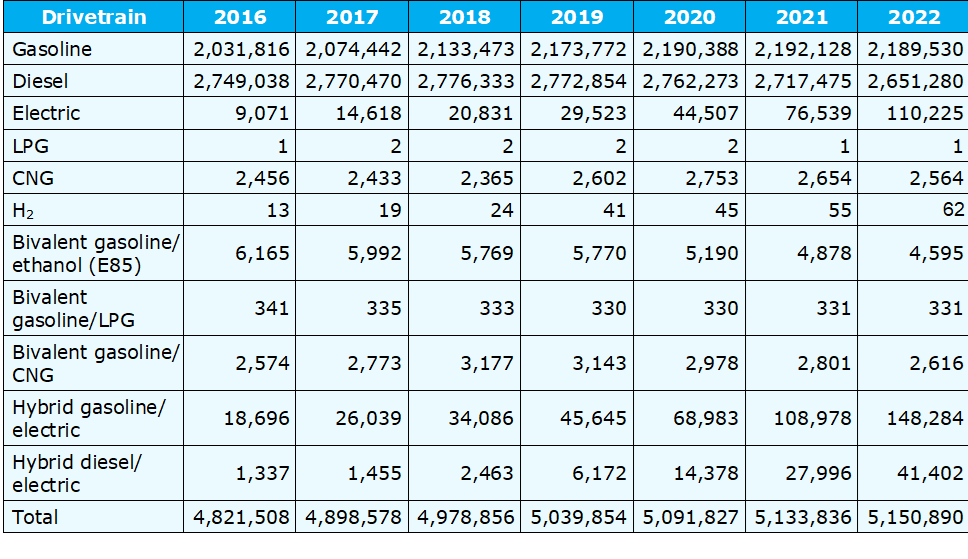

In 2023 the third time in history the total fleet of motor vehicles registered in Austria passed 7 million, with 7.27 million registered motor vehicles – an increase of 0.75% or 54,444 vehicles compared to 2021. Passenger vehicles represent with 5.15 million vehicles (Table 1) the largest share of vehicles (70.9%).

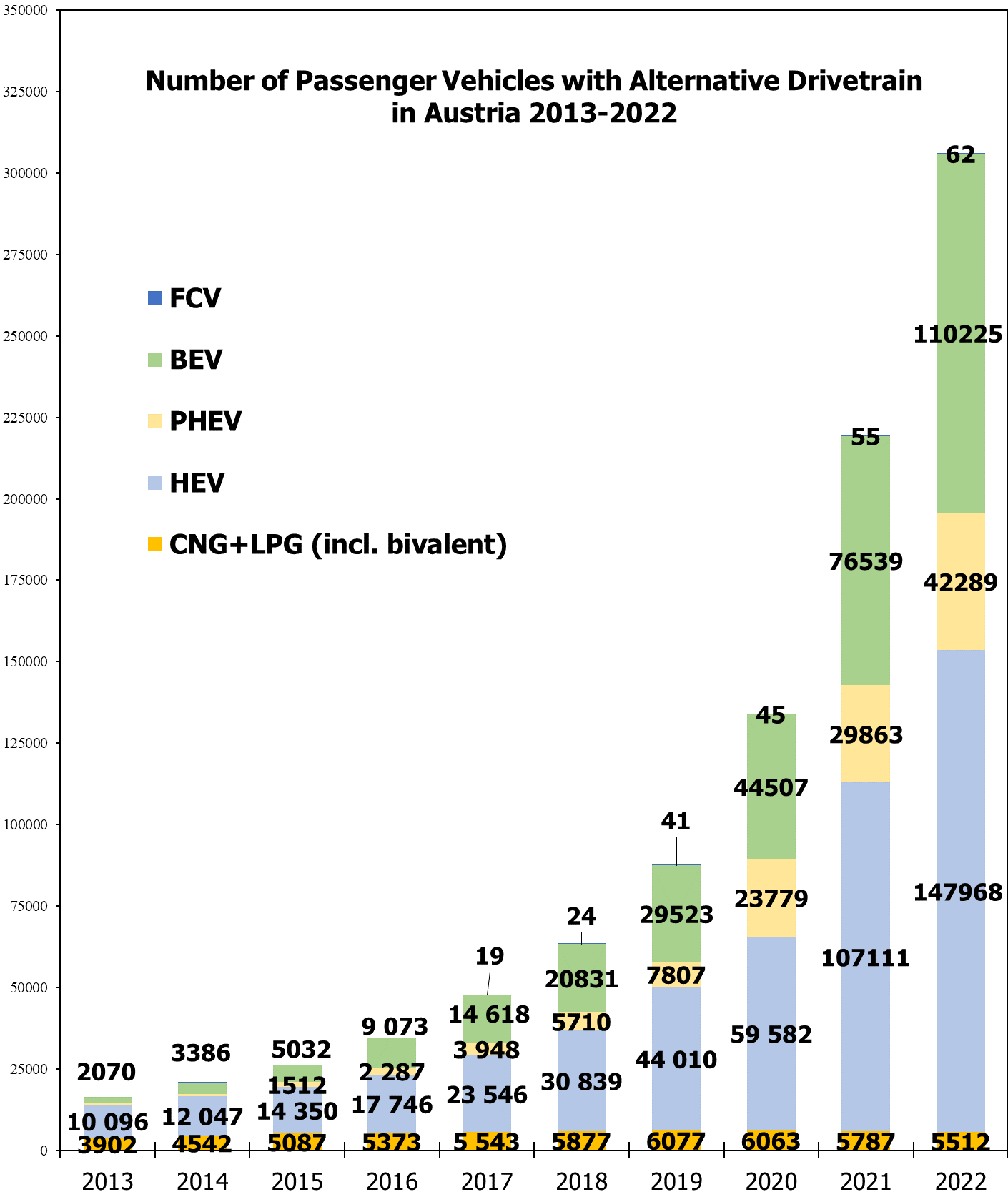

Fleet numbers indicate a continuous trend toward advanced alternative propulsion systems, especially toward BEVs and HEVs (Figure 1). For instance, there were 110,225 BEVs and 147,968 HEVs in Austria in 2022, which shows a continuing positive trend from previous years, and which follows an exponential trajectory. The number of vehicles powered by compressed natural gas (CNG) and liquefied petroleum gas (LPG), including bivalent ones, shows a stable, but very moderate fleet level of 5,512 vehicles (2021: 5,787). There is a continuing slow decrease of bivalent vehicles to 2,947 (2021: 3,132) while the CNG vehicles fleet stays stable with 2,564 (2021: 2,654). With 62 (2020: 55) vehicles, the fuel cell electric vehicle (FCEV) fleet is still negligible.

Table 1. Austrian Fleet Distribution of Passenger Vehicles (M1) by Drivetrain, 2016–2022 / Source: Statistik Austria.

New Registrations

In 2022, 215,050 (2021: 239,803) new passenger cars were registered, a decline of 10.3%, compared to 2021. New passenger car registrations are 34.7% below the level of the pre-crisis year 2019 and reached their lowest level in 43 years. The decline is linked to a continuation of the significant decrease in petrol and diesel-fueled passenger car registrations. The number of petrol-powered passenger cars fell to 78,567 (2021: 91,478), corresponding to a share of 36.5% (2022: 38.1%), and the number of diesel-powered passenger cars fell to 48,155 (2021: 58,263): a share of 22.4% (2021: 35.9%).

Despite the overall trend, at 88,368 (2021: 90,062) cars, the share of all alternatively powered passenger cars increased to 41.1% (2021: 37.6%), thus confirming the continued trend towards alternative drivetrains.

Among the alternative drive trains, a shift towards battery electric vehicles (BEV) was observed, as new registrations for petrol-hybrid passenger cars (40,704; share: 18.9 %) declined by 5.5%. New registrations for diesel-hybrid passenger cars declined by 0.9% (13,422; share: 6.2 %). Only new registrations of BEV passenger cars increased in absolute numbers in 2022: a 2.4 % increase, with 34,165 new registrations and a share of 15.9%. Yet, the number of newly registered BEVs (40,081) still does not match the increase in the total fleet number (plus 54,444 vehicles).

Fig. 1. Trends for vehicles with alternative drivetrains in Austria, 2013–2022 / Source: Statistik Austria.

Average CO2 Emissions of Passenger Cars

In 2022, the CO2 emissions of newly registered passenger cars measured, on average, 134g/km (2021: 135g/km), based on the Worldwide Harmonised Light Vehicles Test Procedure (WLTP) and excluding electric and hydrogen vehicles. The number drops to 112g/km (2021: 116g/km) if electric and hydrogen vehicles are included. The average emissions number for petrol-powered M1 vehicles is 138g/km (2021: 139g/km); diesel-powered passenger vehicles show an average of 149g/km (2021: 150g/km).

Development of Filling Stations

By the end of 2021, Austria had 2,748 publicly accessible filling stations. As an annual average for 2022, the price of gasoline for private use at a filling station was EUR 1.729 (USD 1.89) per liter; correspondingly, the price of diesel was EUR 1.820 (USD 1.99) per liter. With 119 public compressed natural gas (CNG) stations in 2022, the number of public CNG filling stations has continuously decreased in recent years (2021: 125). For liquified petroleum gas (LPG), 41 filling stations are available (2021: 39). In addition, three public liquified natural gas (LNG) filling stations operate, in Ennshafen (Upper Austria), Feldkirchen (Styria), and Vienna.

Austria has seven hydrogen fueling stations (HFSs); five are publicly accessible. Of the other two, access in one is limited to companies, commercial enterprises, and municipalities; and the other is dedicated to hydrogen research. Except for the latter, all HFSs support a pressure of 70 MPa.

Research and Demonstration Focus

Energy Model Region

As part of the “Energy Model Region” initiative, made-in-Austria energy technologies are developed and demonstrated in large-scale, real-world applications with international visibility. In the coming years, the Austrian Climate and Energy Fund (KLIEN) intends to invest up to EUR 120 million (USD 131 million) in three Energy Model Regions. One such region—WIVA P&G— demonstrates the transition of the Austrian economy and energy production to an energy system based strongly on hydrogen. Particular emphasis is focused on the development of hydrogen transport applications. A project database is available online. The WIVA P&G Energy Model Region forms part of the Mission Innovation Hydrogen Valley family.

klimaaktiv mobil Program

Austria’s national action program for mobility management, called klimaaktiv mobil, supports the development and implementation of mobility projects and transport initiatives that aim to reduce CO2 emissions. Since 2004, 21,000 climate friendly mobility projects have been funded. The klimaaktiv mobil website offers a map with details of each project. Total financial support until 2021 amounted to EUR 167.5 million (USD 182.8 million).

IEA Technology Cooperation Programmes Funding

Austria has been actively involved in the IEA Technology Collaboration Programmes (TCPs) since joining the IEA. The TCPs are seen as an important complement to Austrian national energy R&I activities and contribute via Task outcomes to national priorities. This programme fosters Austrian participation in the collaborative work within the IEA, disseminates results and facilitates networking activities.

R&I Mobility Strategy 2030

The R&I Mobility Strategy 2030 provides financial support for R&I projects and R&I activities for sustainable passenger and freight transport. The R&I Mobility Strategy 2030 focuses on four mission areas: Cities, Regions, Digitalization, and Technology. The annual budget ranges from EUR 15 million to 20 million (USD 16.3 million to USD 21.8 million). A project database is available online.

ERA-NET Bioenergy

In the European Research Area (ERA-NET) Bioenergy, Austria cooperates with Germany, Poland, and Switzerland in funding transnational bioenergy research and innovation projects. Austria’s contribution to the recent 14th ERA-NET Bioenergy Joint Call amounts to EUR 0.8 million (USD 0.87 million).

Outlook

Austria is committed to reaching carbon neutrality by 2040, ten years earlier than the EU. The supporting Government Program identifies alternative fuels as indispensable for reaching this ambitious goal. Advanced motor fuels play a crucial role in the Austrian Climate and Energy Strategy and are considered an important element for a successful Austrian transition toward sustainable mobility.

The areas of deployment, though, depend on the use case. Electrification is the preferred option for use cases with limited energy requirements, such as passenger cars or light-duty vehicles with limited mileage. Here, RDI funding schemes are not directed at improving ICE drivetrains any more. Funding programs therefore focus on biofuel and synthetic fuel topics for use cases with high-energy density demands, such as aviation or waterborne applications.

At the moment, Alternative Fuels Infrastructure Regulation (AFIR) is being discussed, which will outline a framework for the future deployment of charging and refueling infrastructure across the European Union. The document will include mandatory targets for member states instead of today’s indicative targets.

Additional Information Sources

- Federal Ministry for Climate Action, Environment, Energy, Mobility, Innovation and Technology, http://www.bmk.gv.at/