Advanced Motor Fuels in Republic of Korea

Drivers and Policies

Renewable Fuel Standards (RFS)

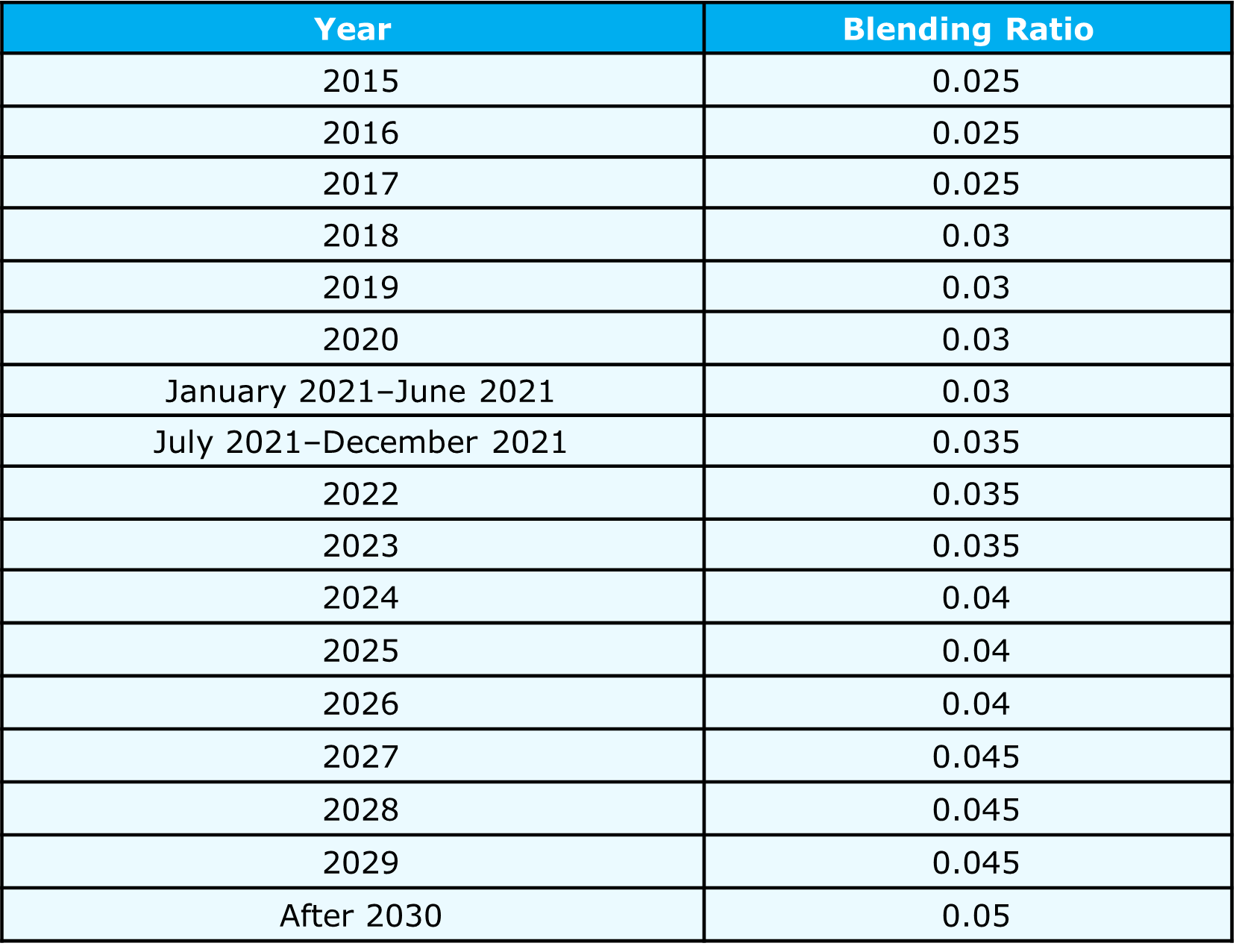

Since 2006, South Korea has been blending 0.5% biodiesel into diesel fuel. In July 2015, with the implementation of the Renewable Energy Fuel Blending Mandate under the Renewable Energy Act, the blending ratio has been gradually increased. Through the 2021 amendment of the law, the government established annual mandatory blending ratios up to 2030 (Table 1). These ratios are reviewed every three years, taking into account the development level of renewable energy technologies and fuel supply conditions. However, the review period may be shortened depending on the performance of the renewable energy fuel blending obligation and changes in domestic and international market conditions.

The annual mandatory blending volume is calculated as follows:

Annual mandatory blending volume = (Annual mandatory blending ratio) × [Domestic sales volume of transportation fuels (including blended renewable energy fuels)]

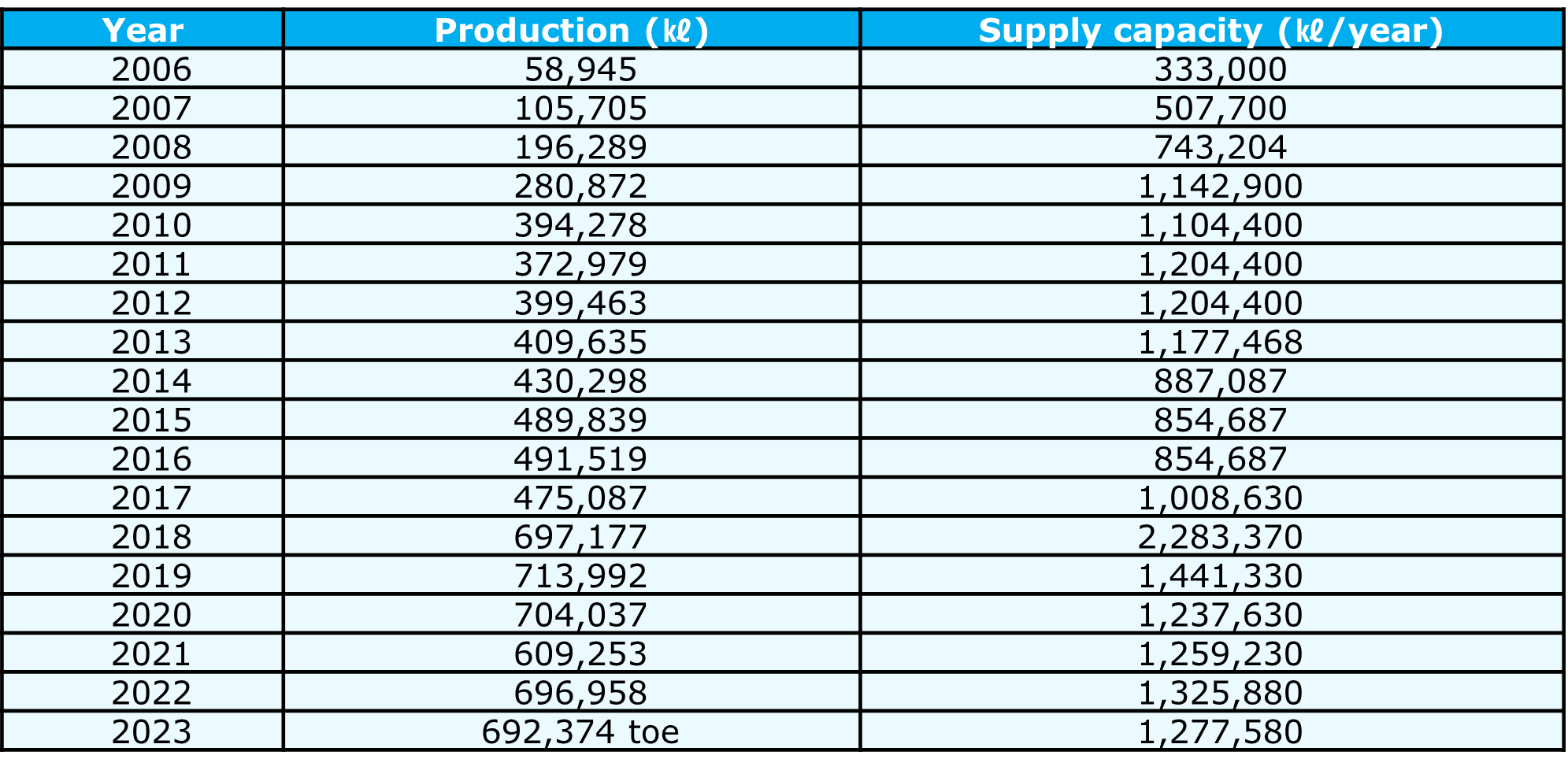

As of 2023, the annual production capacity of the nine companies producing biodiesel is 1.449 million kL, which exceeds the current distribution volume of approximately 911,000 kL. Considering the projected distribution volume up to 2030, it is expected that domestic supply will be sufficient without additional expansion.

Table 1. Ratio of New and Renewable Energy Fuel Blending to Transportation Fuela

a To determine the compulsory blending amount by year, multiply the compulsory blending ratio by year by the domestic sales volume of transportation fuel, including mixed renewable energy fuels.

Starting from 2024, the blending ratio of biodiesel has been increased to 4%. This adjustment aims to enhance the utilization of renewable energy sources and contribute to reducing greenhouse gas emissions. The policy change reflects the government’s commitment to promoting sustainable fuel alternatives and aligning with global carbon neutrality goals.

Additionally, the Eco-Friendly Biofuel Expansion Plan announced the introduction of next-generation biodiesel, with plans to increase the mandatory blending ratio from the current 5% to a maximum of 8%. Next-generation biodiesel refers to biodiesel produced by adding hydrogen to animal and vegetable oils, and it is currently undergoing demonstration research.

Advanced Motor Fuels Statistics

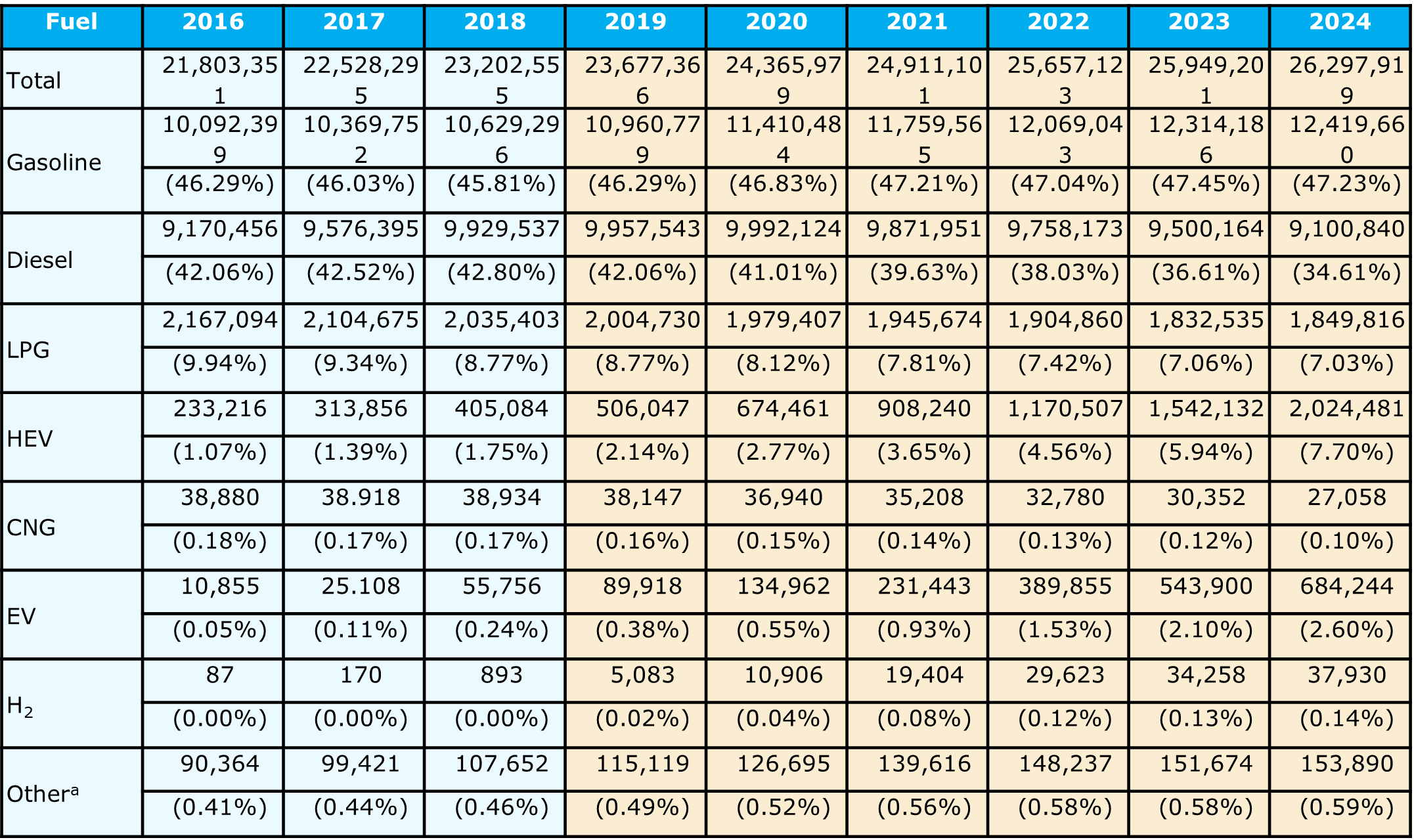

Table 2 lists the number and ratio of vehicles registered in Korea by year and fuel type from 2016 to 2024.

Table 2. Vehicles Registered in Korea, 2016–2024

a Other fuels (kerosene, alcohol, solar, liquefied natural gas [LNG]) and towed vehicles (trailers, etc.)

As of 2024, the cumulative number of registered vehicles in South Korea reached 26,297,919, marking a 1.34% increase (348,718 vehicles) compared to the previous year. The number of eco-friendly vehicles (EVs, hydrogen vehicles, and HEVs) continued to grow in 2024, following the trend from 2023 and accounting for 10.4% (2,746,655 vehicles) of the total registered vehicles. Notably, HEVs saw a 31.3% increase (482,349 vehicles) compared to 2023, while EVs increased by 25.8% (140,344 vehicles) over the same period. The government is working to expand domestic production of EVs and hydrogen vehicles in line with its revised target to promote 4.5 million units by 2030.

Research and Demonstration Focus

Biodiesel

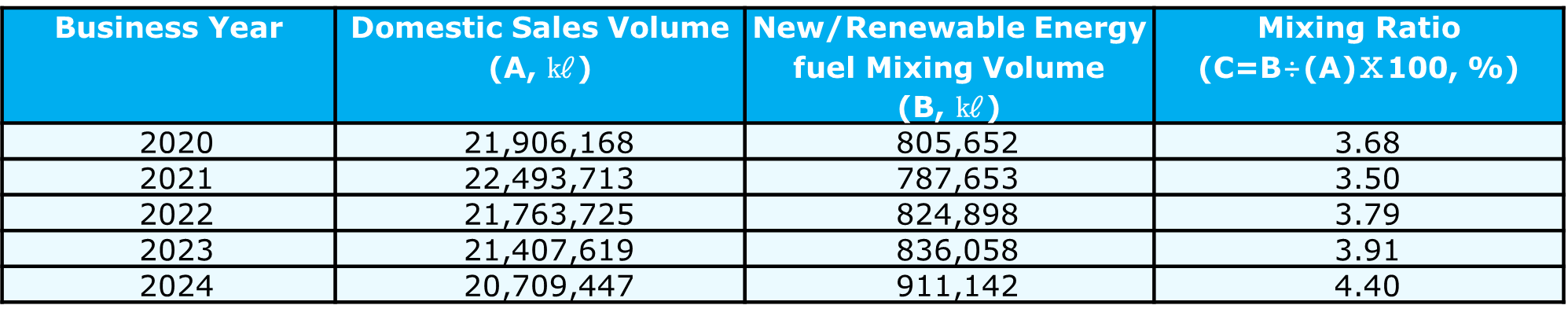

Biodiesel is mainly made using waste cooking oil, animal oil, palm oil, and byproducts (palm fat acid distillate [PFAD]) of refined palm oil. Biodiesel, which has been in use since 2006, is distributed by mixing 4% (2024) in diesel for automobiles. Based on the total domestic sales and fuel mixing of the mixed obligators by year, the mixing performance ratios from 2020 to 2024 were 3.68%, 3.50%, 3.79%, 3.91%, and 4.40%, respectively, indicating that the target obligation ratio stipulated in the law has been achieved each year (Table 3).

Table 3. Year-over-year Performance of RFS Obligations for Transportation

Source: Korea Petroleum Quality & Distribution Authority (K-Petro).

As the mandatory blending volume of biodiesel in South Korea increases, the overall supply capacity is also rising (Table 4). However, due to the sufficient supply relative to the current domestic biodiesel demand, the supply capacity has slightly declined. In 2023, the conversion factor for biodiesel was not announced, so it was recorded in tons of oil equivalent (toe).

Table 4. Domestic Biodiesel Supply Performance by Year

Source: Ministry of Trade, Industry and Energy/Korea Energy Agency, “2023 New/Renewable Energy Supply Statistics.”

Hydrogen and Electricity

Under the “First National Strategy for Carbon Neutrality and Green Growth,” the South Korean government has set a target to deploy 4.5 million electric and hydrogen vehicles by 2030. To achieve this goal, the government is promoting purchase subsidies and tax incentives for electric and hydrogen vehicles; differentiating subsidies based on performance factors such as driving range per charge; and reviewing tax support measures considering the environmental impact of vehicles. Additionally, the Low-Emission Vehicle Supply Mandate will be restructured to focus on zero-emission vehicles and, from 2023, the government will implement a flexible compliance system and contribution fees to further boost the supply of zero-emission vehicles.

By 2030, the government aims to significantly improve the driving range and durability of electric and hydrogen vehicles, enhance energy efficiency, and develop ultra-fast charging technology capable of fully charging high-voltage EVs within five minutes. Furthermore, the development of 5-ton and 10-ton hydrogen-powered special-purpose vehicles, ultra-compact EVs, and medium-sized electric trucks and buses will be promoted to support market entry for small and medium-sized enterprises (SMEs).

To diversify hydrogen mobility, the government plans to ensure durability and driving range equivalent to internal combustion engine vehicles by 2030 and establish a mass production system for hydrogen passenger, commercial, and special-purpose vehicles. Additionally, subsidies will be concentrated on commercial vehicles and ships, while the zero-emission vehicle purchase mandate and mandatory public sector procurement ratio will be increased to accelerate the transition to eco-friendly fuels.

Ammonia

The Korea Institute of Machinery & Materials (KIMM), in collaboration with Hyundai Motor Company and Kia, successfully developed the world’s first 2-liter class pure ammonia direct injection engine. This groundbreaking engine can utilize ammonia, a hydrogen carrier, as a direct fuel source without requiring additional processing. It employs a high-pressure liquid injection system to ensure the stable supply of large volumes of ammonia fuel. Moreover, it can be used without additional combustion enhancement devices or additives.

HD Hyundai Heavy Industries has developed the world’s first high-pressure direct injection ammonia dual-fuel engine (HiMSEN, H22CDF-LA). Compared to conventional low-pressure premixed systems, it offers enhanced output (1.4–2.2 MW) and improved fuel efficiency, while significantly reducing greenhouse gas emissions, including N₂O. Additionally, HD Korea Shipbuilding & Offshore Engineering has successfully applied its proprietary Integrated Ammonia Scrubber, achieving a significant reduction in ammonia emissions. The company is also developing the H32CDF-LA engine, which will have an output of 3.6–5.4 MW.

The Korea Institute of Energy Research (KIER) has pioneered an ammonia decomposition-based clean hydrogen production technology that achieves zero carbon dioxide emissions. This innovation enables the production of high-purity hydrogen that meets international standards for hydrogen fuel cell vehicles without generating any carbon emissions.

e-Fuel (Synthetic Fuel)

The Ministry of Environment of Korea is preparing a roadmap for synthetic fuel manufacturing standards and an emission certification system to facilitate the introduction of e-fuel. Research is currently underway to establish fuel quality standards, testing methods, emission components, and testing procedures for synthetic fuel.

The Ministry of Trade, Industry, and Energy held the “Renewable Synthetic Fuel (e-Fuel) Research Council,” where the government, industry, academia, and research sectors gathered to present policy and technical challenges for achieving carbon neutrality through the use of e-fuel.

The Korea Institute of Machinery and Materials (KIMM) has reduced the amount of catalyst required for e-fuel production by 30% and developed a microchannel reactor with 30 times the capacity of conventional reactors. The microchannel reactor is about one-fifth the size of traditional reactors, enhancing reactor integration and enabling a modular configuration. This allows for easier reactor control and improved stability.

Outlook

The South Korean government is laying the groundwork for the introduction of new types of transportation fuels, such as e-fuel and ammonia, while also expanding the blending ratio of existing biofuels, continuing its efforts toward carbon neutrality.

Biodiesel

The South Korean government plans to gradually increase the mandatory biodiesel blending ratio, targeting 8% by 2030 under the Eco-Friendly Biofuel Expansion Plan. In 2024, the blending ratio was raised to 4%, and next-generation biodiesel, produced by hydrogenating animal and vegetable oils, is currently undergoing demonstration research.

Alternative fuels

South Korea is developing methanol dual-fuel engines through HD Hyundai Heavy Industries to reduce emissions from ships and is also working on engine development and optimization to utilize methanol combustion in the automotive industry.

Additionally, Korea is securing technologies for producing new automotive fuels such as ammonia and e-fuel, while simultaneously researching utilization technologies to improve combustion efficiency and reduce emissions, aiming to diversify carbon-neutral fuel options.

Additional Information Sources

- K-Petro

- Korea Register

- Ministry of Trade, Industry and Energy

- Ministry of Environment

- Korea Automobile Manufacturers Association