Advanced Motor Fuels in Japan

Drivers and Policies

Since the previous revision of the Strategic Energy Plan in October 2021, the energy situation surrounding Japan has changed dramatically. In light of these changes, METI revised the Strategic Energy Plan in a manner that is consistent with the new target of reducing greenhouse gases by 73% in FY2040 (from FY2013). A Cabinet Decision was made on the Seventh Strategic Energy Plan on February 18, 2025, after going through the Public Comment Procedure and other processes.[1]

In June 2021, the Ministry of Economy, Trade and Industry (METI), in collaboration with other ministries and agencies, formulated the “Green Growth Strategy through Achieving Carbon Neutrality in 2050.”[2] The strategy specifies 14 promising fields that are expected to grow and provides representatives of these fields with action plans from the viewpoints of both industrial and energy policies. Japan upholds an ambitious goal while demonstrating realistic pathways to meet that goal wherever possible. A 20-trillion-yen Green Innovation Fund has been established to encourage companies to take on ambitious challenges.[3] In December 2023, to simultaneously achieve the three goals of decarbonization, economic growth, and a stable energy supply through GX (green transformation), the Government of Japan compiled “Sector-specific Investment Strategies” for 10 years in the prioritized fields as an effort to improve companies’ predictability and strongly encourage companies to invest in GX. [4]

In conjunction with the GX2040 Vision and the Plan for Global Warming Countermeasures, both of which were approved by the Cabinet, February 18, 2025, the government will strive to achieve stable energy supply, economic growth, and decarbonization simultaneously. In the road transport sector, the GX2040 vision is based on the pursuit of “variety of options” such as synthetic fuels and hydrogen, and newly stipulates that “with regard to fuel cell vehicles, emphasis will be placed on commercial vehicles,” “additional support will be provided to priority regions,” and “aiming for carbon neutral through the decarbonization of internal combustion engine fuels, and utilization of biofuels and synthetic fuels.”[5]

To decarbonize the transportation sector, Japan will promote the reduction of CO2 emissions through the production, use, and disposal of automobiles; the improvement of energy efficiency in the logistics sector; and the decarbonization of fuel itself.[6], [7]

For passenger cars, comprehensive measures such as expanding the introduction of electrified vehicles and infrastructures and reinforcing technologies related to electrified vehicles (e.g., batteries, supply chain, and value chain) will be taken to achieve 100% electrified vehicle sales by 2035.

For commercial vehicles, the following electrification targets were set:[8]

- Electrified vehicles account for 20–30% of new light vehicle sales by 2030, with electrified vehicles and decarbonized fuel vehicles to account for 100% by 2040.

- An advanced introduction of 5,000 heavy vehicles in the 2020s and a target by 2030 for 2040 electrified vehicle penetration.

Advanced Motor Fuels Statistics

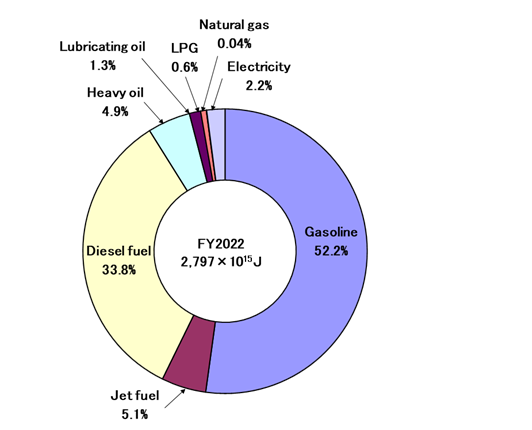

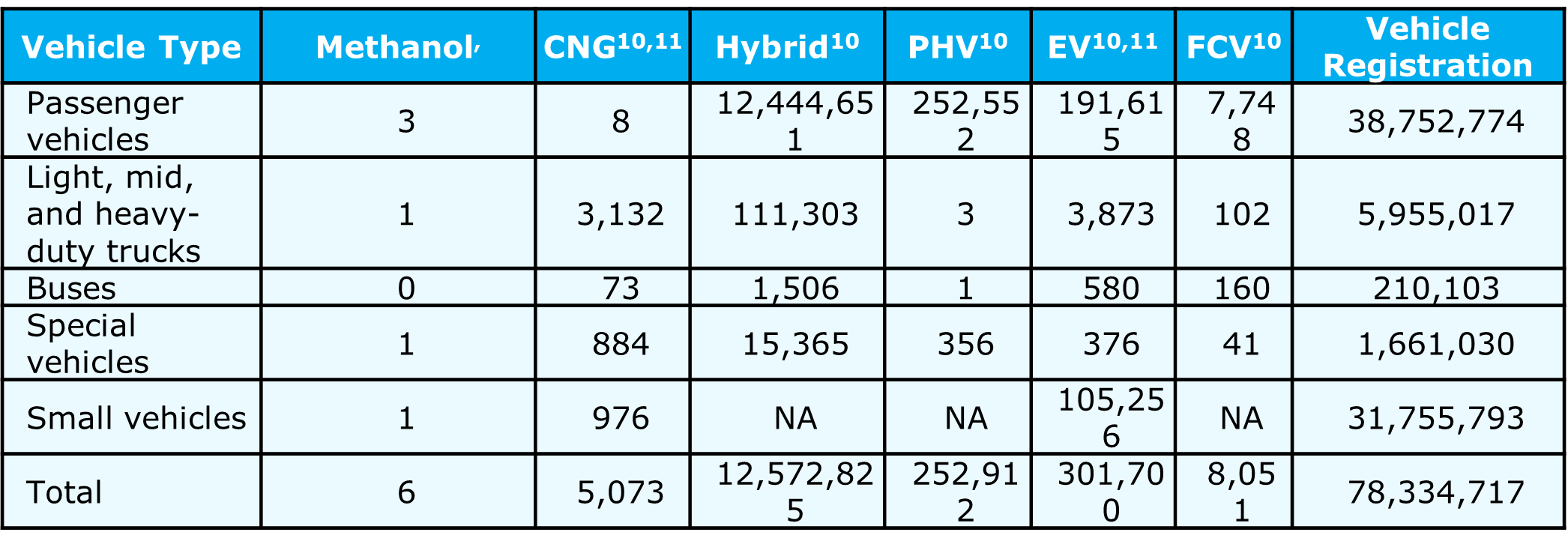

Figure 1 shows the energy sources used in the transportation sector in Japan.[9] Oil-related energy accounts for 97.9% of total usage. The market for alternative fuels is very small in Japan, as is the number of alternative fuel vehicles owned (Table 1). Methanol vehicles, compressed natural gas (CNG) vehicles, hybrid and plug-in hybrid vehicles (HEVs and PHVs), electric vehicles (EVs), and fuel cell vehicles (FCVs) currently constitute the environmentally friendly vehicle options in Japan.

The number of hybrid vehicles is rather large, owing to the number of passenger hybrid vehicles. CNG and hybrid vehicles currently account for the largest number of vehicles in the low-emission truck category. The penetration of FCVs in the market has expanded: Japan has 8,051 FCVs.

Figure 1. Energy Sources Used in the Transportation Sector in Japan, 2021

Table 1. Penetration of Environmentally Friendly Vehicles Owned in Japan, March 2023

Research and Demonstration Focus

Hydrogen

In 2017, Japan formulated the world’s first national hydrogen strategy, the Basic Hydrogen Strategy. Under this strategy, Japan achieved several accomplishments: commercialization of the world’s first FCVs, increased utilization of fuel cells by households, and a world-class number of related patents. In this context, Japan’s efforts to transition into a hydrogen-based society are moving from the technology development phase to the commercial phase.

In June 2023, the Basic Hydrogen Strategy was revised[13] to include two new basic pillars: the “Hydrogen Industry Strategy” — a policy for strengthening the industrial competitiveness of hydrogen — and the “Hydrogen Safety Strategy” — a policy for the safe use of hydrogen. This revised strategy will be reviewed within a 5-year period.

With regard to the use of hydrogen in mobility, Japan is providing support for the spread of fuel cell vehicles and the development of hydrogen stations. Commercial vehicles such as trucks are one of the areas where hydrogen utilization is expected in the transportation field; trucks need to transport goods daily over long distances, which is difficult for EVs given their range limitations. In the future, the spread of FCVs and the systematic development of hydrogen refueling stations will be accelerated. In particular, the cumulative number of fuel cell trucks on the road is expected to reach 15 million by 2050, at a value of approximately USD 2.7 trillion. In terms of refueling infrastructure, approximately 1,000 hydrogen stations will be installed in optimal locations by 2030, in anticipation of the widespread use of FCVs including fuel cell buses and trucks. Nationwide as of December 2023, hydrogen stations for FCVs operated in 161 locations.[14]

In response to Japan’s hydrogen strategy, the New Energy and Industrial Technology Development (NEDO) CO2-free Hydrogen Energy Supply-chain Technology Research Association (HySTRA) pilot project (the marine transportation and unloading of liquid hydrogen produced in Australia and delivered to Japan) was initiated in May 2021.[15] The world’s first liquefied hydrogen carrier, the Suiso Frontier, departed Victoria, Australia, on January 28, 2022, marking a significant milestone for the pilot project. Built by Kawasaki Heavy Industries Ltd., the Suiso Frontier enables the safe transport of liquefied hydrogen in large quantities from the Port of Hastings, Victoria, to Kobe, Japan.

To establish a safer and more efficient cargo-handling operation, on March 4, 2023, HySTRA successfully conducted a handling demonstration test using the world’s first rigid-type loading arm system (LAS) for ship-to-shore transfer of liquefied hydrogen. The new rigid-type LAS, installed at the “Hy touch Kobe,” offers a more compact design compared with existing hose-type LASs, which is advantageous to increase the size of the system in the near future.

Because hydrogen engines can leverage well-established internal combustion engine (ICE) technologies, they have a high potential for commercialization at lower cost. Toyota has installed the hydrogen engine in a commercial light-duty vehicle (HiAce) to conduct on-road feasibility testing by fleet operators on public roads in Australia.[16]

Natural Gas

Approximately 80% of the natural gas vehicles (NGVs) in Japan are commercial vehicles, such as trucks, buses, or special vehicles (mainly garbage trucks). Of the trucks, the majority are light- to medium-duty vehicles designed for short- or medium-distance transportation. In this context, Isuzu Motors Limited released a CNG heavy-duty truck in December 2015[17] and a heavy-duty LNG truck in October 2021.[18] Mitsubishi Corporation and Air Water Inc. have jointly developed Japan’s first compact LNG filling facility for LNG-powered trucks. They launched trial operations of the facility and LNG trucks in Hokkaido under the Ministry of the Environment’s Low Carbon Technology R&D Program on November18, 2022.[19] This project uses LNG mixed with liquified bio methane (LBM) refined from livestock manure-based biogas, which is expected to be a carbon-negative fuel. In October 2024, the cumulative number of LNG fillings into LNG-powered trucks reached 3,000, with a total filling volume of approximately 470 tons.

Biofuel

With respect to initiatives aiming to encourage the use of biofuels in Japan, sales of gasoline blended with ethyl tertiary-butyl ether (ETBE) in FY 2022 again achieved the target defined in the Act on Sophisticated Methods of Energy Supply Structures (500,000 kL [crude oil equivalent] of bioethanol and 1.94 million kL of bio-ETBE each year).[20] According to trade statistics, approximately 57,825 kL of ethanol were imported (mainly from Brazil) in FY 2022 as raw material for ETBE (equivalent to roughly 127,900 kL of ETBE).[21]

E-fuel

In order to achieve a cost lower than the price of gasoline for synthetic fuels in 2050, Japan will work on the commercialization of synthetic fuels. In addition to improving the efficiency of existing technologies (reverse shift reaction plus Fischer Tropsch [FT] synthesis process) and designing and developing production facilities, innovative new technologies and processes (e.g., co-electrolysis, direct-FT) will be developed as part of an integrated production process for synthetic fuels. The Green Growth Strategy aims to establish high-efficiency and large-scale production technology by 2030, expand the introduction and reduce costs during the 2030s, and achieve independent commercialization by 2040 by intensively developing and demonstrating technologies for such synthetic fuels over the next 10 years.[22]

METI launched the “Public-private sector council to promote the introduction of synthetic fuels (e‑fuel)” on September 16, 2022, and the “Public-private sector council for methanation promotion” on June 28, 2021, to address issues such as technology and price to enable commercialization of synthetic fuels through public-private partnership.[23]

On March 2, 2022, 16 companies — including airlines and plant construction companies — announced the launch of “Act for Sky,” an organization that will transcend industry boundaries with the aim of domestically producing sustainable aviation fuel (SAF), an alternative fuel for aircraft. The organization will research stable procurement of used cooking oil and other raw materials and methods to produce it at reduced cost.[24]

Alternative fuels research project promoted by the government

With the aim of early social implementation for the above alternative fuel use, the Next-Generation Environmentally Friendly Vehicles Development and Commercialization Project is promoted by Ministry of Land, Infrastructure, Transport and Tourism (MLIT). The project started in 2002 and is currently in its sixth phase. Each stage is five years in length and has several research aspects. In the current phase the research aspects relating to alternative fuels use are hydrogen internal combustion engines, and compression ignition engines with synthetic carbon fuels, which origine is from Bio or Direct Air Capture.[25]

Outlook

In a “Green Growth Strategy towards 2050 Carbon Neutrality,” Japan will promote the electrification of automobiles and take comprehensive measures to achieve 100% electrified vehicles (EVs, FCVs, HEVs and PHVs) in new passenger car sales by the mid-2030s at the latest. Furthermore, through efforts to neutralize energy such as e-fuel, Japan aims to achieve net zero emissions through the production, use, and disposal of automobiles in 2050.

Additional Information Sources

- METI, “Overview of Japan’s Green Growth Strategy Through Achieving Carbon Neutrality in 2050,” January 2021.

Benefits of Participation in the AMF TCP

Participation in the AMF TCP makes it possible to obtain the latest information on advanced motor fuels for stakeholders, policy makers, and industries. AMF TCP activities facilitate an international network on advanced motor fuels.

[1] The Ministry of Economy, Trade and Industry, “Cabinet Decision on the Seventh Strategic Energy Plan,” https://www.meti.go.jp/english/press/2025/0218_001.html.

[2] METI, June 12, 2022, “Green Growth Strategy through Achieving Carbon Neutrality in 2050,” https://www.meti.go.jp/english/policy/energy_environment/global_warming/ggs2050/index.html.

[3] METI, August 31, 2021, “Budget (Green Innovation Fund),” https://www.meti.go.jp/english/policy/energy_environment/global_warming/ggs2050/pdf/1_budget.pdf.

[4] METI, December 22, 2023, “Sector-specific Investment Strategies: Compiled as Effort for Specifying Investment Promotion Measures for the Realization of GX,” https://www.meti.go.jp/english/press/2023/1222_002.html.

[5] METI, February 18,2025, https://www.meti.go.jp/press/2024/02/20250218004/20250218004.html (in Japanese)

[6] Agency for Natural Resources and Energy, October 2021, “Outline of Strategic Energy Plan,” https://www.enecho.meti.go.jp/en/category/others/basic_plan/pdf/6th_outline.pdf.

[7] Agency for Natural Resources and Energy, October 2021 (in Japanese), “Strategic Energy Plan,” https://www.enecho.meti.go.jp/category/others/basic_plan/pdf/20211022_01.pdf.

[8] METI, “Automobile/battery industries,” https://www.meti.go.jp/english/policy/energy_environment/global_warming/ggs2050/pdf/05_automobile.pdf.

[9] Agency for Natural Resources and Energy, June 6, 2023, “Cabinet Decision Made on the FY2022 Annual Report on Energy (Japan’s Energy White Paper 2023),” https://www.meti.go.jp/english/press/2023/0606_003.html.

[10] Automobile Inspection and Registration Information Association, as of March 2024 (in Japanese), https://www.airia.or.jp/publish/file/v19mrm00000019mo.pdf.

[11] Japan Light Motor Vehicle and Motorcycle Association, as of March 2024 (in Japanese), https://www.keikenkyo.or.jp/Portals/0/files/information/statistics/etc/kankatubetu_nenryobetuR0603.pdf.

[12] Automobile Inspection and Registration Information Association, as of March 2024 (in Japanese), https://www.airia.or.jp/publish/file/v19mrm0000000bx7.pdf.

[13] The Ministerial Council on Renewable Energy, Hydrogen and Related Issues, June 6, 2023, “Basic Hydrogen Strategy,” https://www.meti.go.jp/shingikai/enecho/shoene_shinene/suiso_seisaku/pdf/20230606_5.pdf.

[14] Next Generation Vehicle Promotion Center (in Japanese), http://www.cev-pc.or.jp/suiso_station/index.html.

[15] HySTRA (CO₂-free Hydrogen Energy Supply-chain Technology Research Association), “Hydrogen Supply Chain: Hydrogen Energy Supply Chain Pilot Project between Australia and Japan,” https://www.hystra.or.jp/en/project/.

[16] Toyota, November 11, 2023, “Evolution of Hydrogen Technology and Taking on New Challenges in Australia,” https://global.toyota/en/newsroom/corporate/40081554.html.

[17] Isuzu Motors Limited (in Japanese), https://www.isuzu.co.jp/product/cng/giga.html.

[18] Isuzu Motors Limited (in Japanese), https://www.isuzu.co.jp/newsroom/details/20211028_01.html.

[19] Mitsubishi Corporation, “Introduction of Trial Operations of Compact

LNG Filling Facilities for LNG Trucks in Hokkaido,” https://www.mitsubishicorp.com/jp/en/bg/natural-gas-group/topics/lng-filling-facilities/.

[20] Japan Biofuels Supply LLP, https://www.jbsl.jp/english/objective/.

[21] Japan Alcohol Association (in Japanese), http://www.alcohol.jp/statis/import.pdf.

[22] The Ministry of Economy, Trade and Industry, “Green Growth Strategy Through Achieving Carbon Neutrality in 2050,” Formulated, June 2021 https://www.meti.go.jp/english/press/2021/0618_002.html.

[23] METI, “Public-private sector council to promote the introduction of synthetic fuels (e-fuel),”

https://www.meti.go.jp/shingikai/energy_environment/e_fuel/001.html.

[25] https://www.ntsel.go.jp/Portals/0/resources/forum/2024files/NTSELForum2024_LecPoster01.pdf (in Japanese).