Advanced Motor Fuels in Germany

Drivers and Policies

Germany has set significant targets to reduce greenhouse gas (GHG) emissions on both the European Union (EU) and national levels (e.g., European Green Deal and Federal Climate Change Act). The transition toward decarbonization progressed in 2024 despite another year marked by the ongoing Russian invasion of Ukraine and other challenging incidents, globally and on the national level. On a national level, the break-up of the German government in November 2024 can be considered the most challenging threat. The elections of the German Bundestag in February 2025 indicated a change in the German government. While the new government’s progress and agenda cannot be predicted, it is likely that energy security and climate change mitigation will remain two of the key priorities of the new German government. Further, it can be expected that previously agreed legal frameworks such as the Climate Change Act or the Climate Action Programme will remain in force. Even if slight changes and amendments occur, the new government is likely to aim to continue the energy transition by remaining independent from Russian oil and gas, encouraging energy savings and costs reductions for renewable energies, building liquefied natural gas (LNG) terminals, and creating a bridge to hydrogen utilization.

Massive budget cuts for climate protection measures have been implemented in 2024 and are expected for the upcoming years as well. Due to a decision by the Federal Constitutional Court in November 2023, 60 billion Euros in the Climate Transformation Funds (KTF) was deemed not constitutionally compliant and had to be removed from the budget plans.[1] This caused a number of disruptions. For example, by the end of 2023, the purchase bonus for electric vehicles expired due to the necessary savings arising for e-mobility, causing strong sales decreases. However, the government agreed on a solution for further funding of climate and energy actions. Thus, for example, the hydrogen industry was funded with 1.27 billion Euros in 2024.

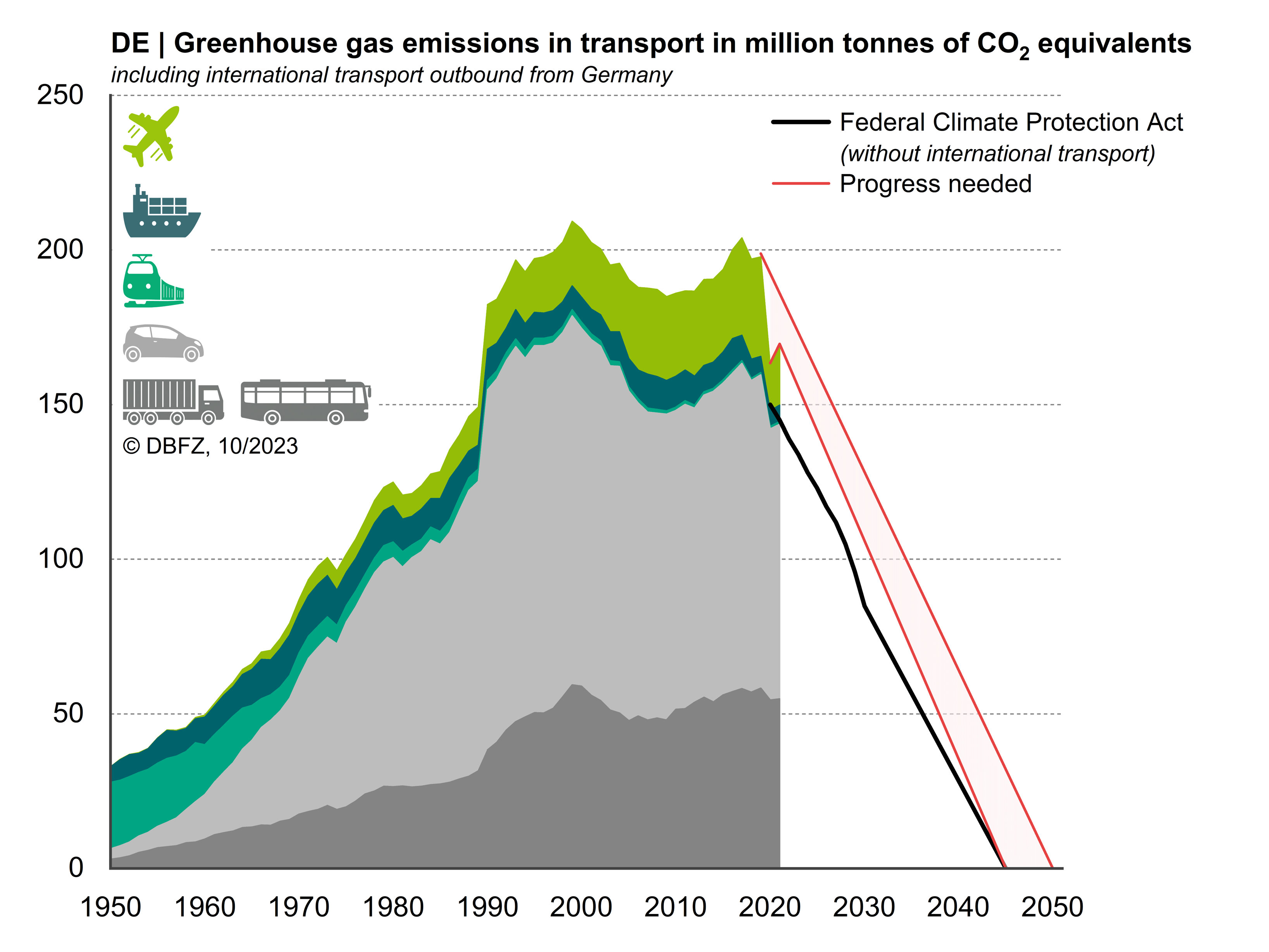

In the Climate Change Act, Germany set binding targets of at least a 65% decrease in GHG emissions by 2030 (compared to 1990 levels) and aims to reach the ambitious goal of becoming carbon-neutral by 2045.[2] For the first time, Germany managed to reach its GHG emissions goals in 2023 and could continue this trend in 2024. According to calculations of the Federal Environment Agency, the CO2 emissions have further decreased in 2024 by 23 million tons (3.4 %) compared to 2023.[3] Thus, the government is optimistic that the nation can also reach its goals for 2030.[4] Notably, CO2 reductions in 2024 could be achieved due to significant savings in the energy economy, industrial sector and agriculture whereas the transport and building sector missed their reduction goals.[5] The permissible emission budget for the transport sector is 85 million tonnes (Mt) carbon dioxide equivalent (CO2-eq) in 2030. The federal government forecasts a cumulative compliance gap of 180 Mt CO2-eq for the transport sector by 2030.[6]

While national and sector-wide GHG emissions reduction targets for 2030 are in line with the German long-term strategy, they are not always reflected in sector-specific national contributions (i.e., EU energy efficiency target) and policies and measures (e.g., in the transport sector). These measures, specified in the Climate Action Programme 2030, target a GHG emissions reduction in the transport sector of only 41–42% by 2030,[7] which translates to 98 to 95 Mt CO2-eq GHG emissions in the transport sector by 2030.[8] A recast of the Klimaschutzgesetz (Climate Protection Act) came into force in July 2024, reducing the need for countermeasures in individual sectors when missing the target values.[9]

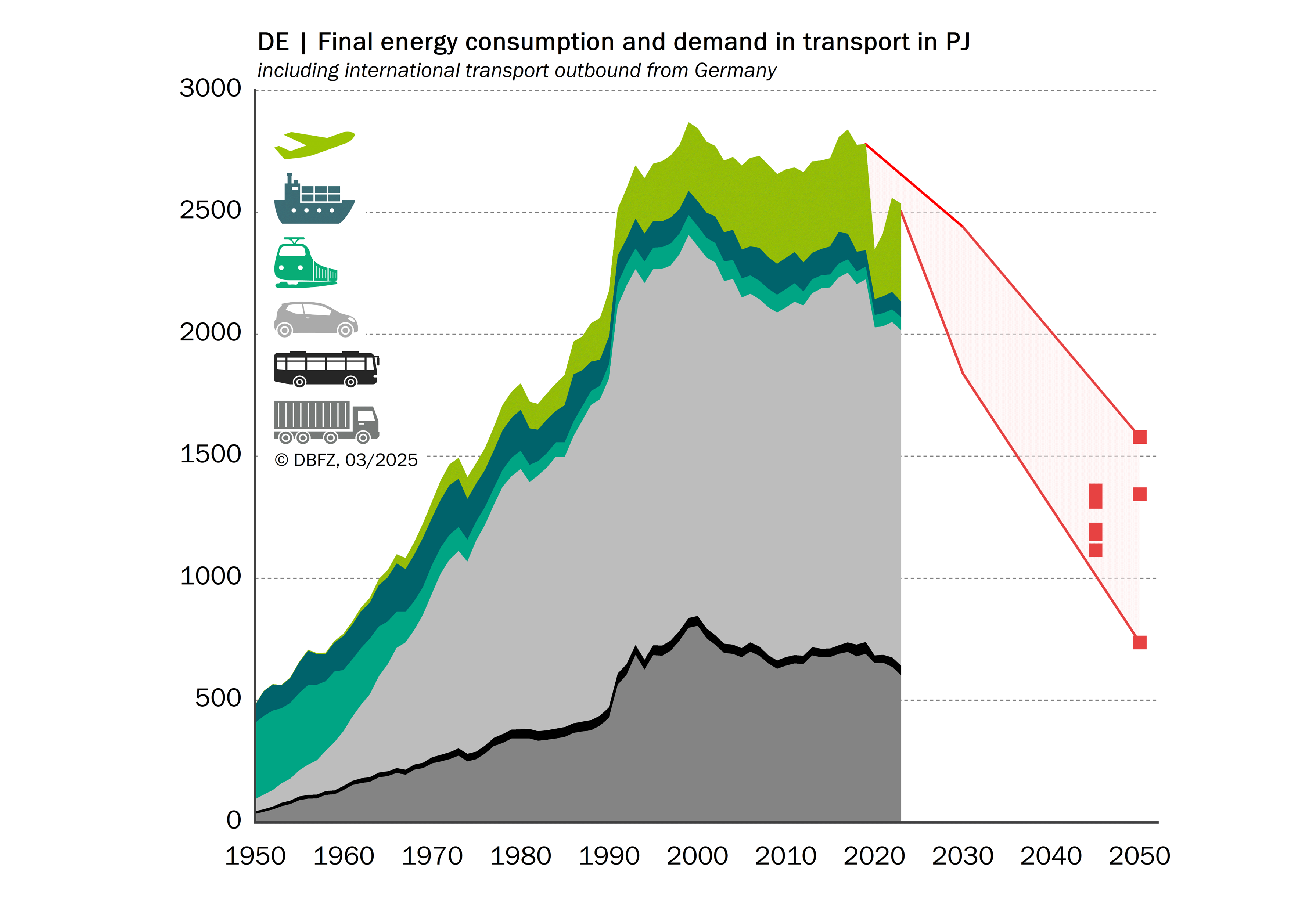

Although Germany has already taken comprehensive climate measures, further efforts are required to achieve the CO2 savings goal formulated in the Climate Change Act.[10] Figure 1 illustrates the massive gap between trends and targets in the transport sector, highlighting that significant action must be taken quickly to reach the GHG emissions target of 85 Mt CO2-eq by 2030.

Figure 1. The massive gap between trends, targets, and scenarios in transport, 1990–2050[11] (Source: German Biomass Research Center [DBFZ]).

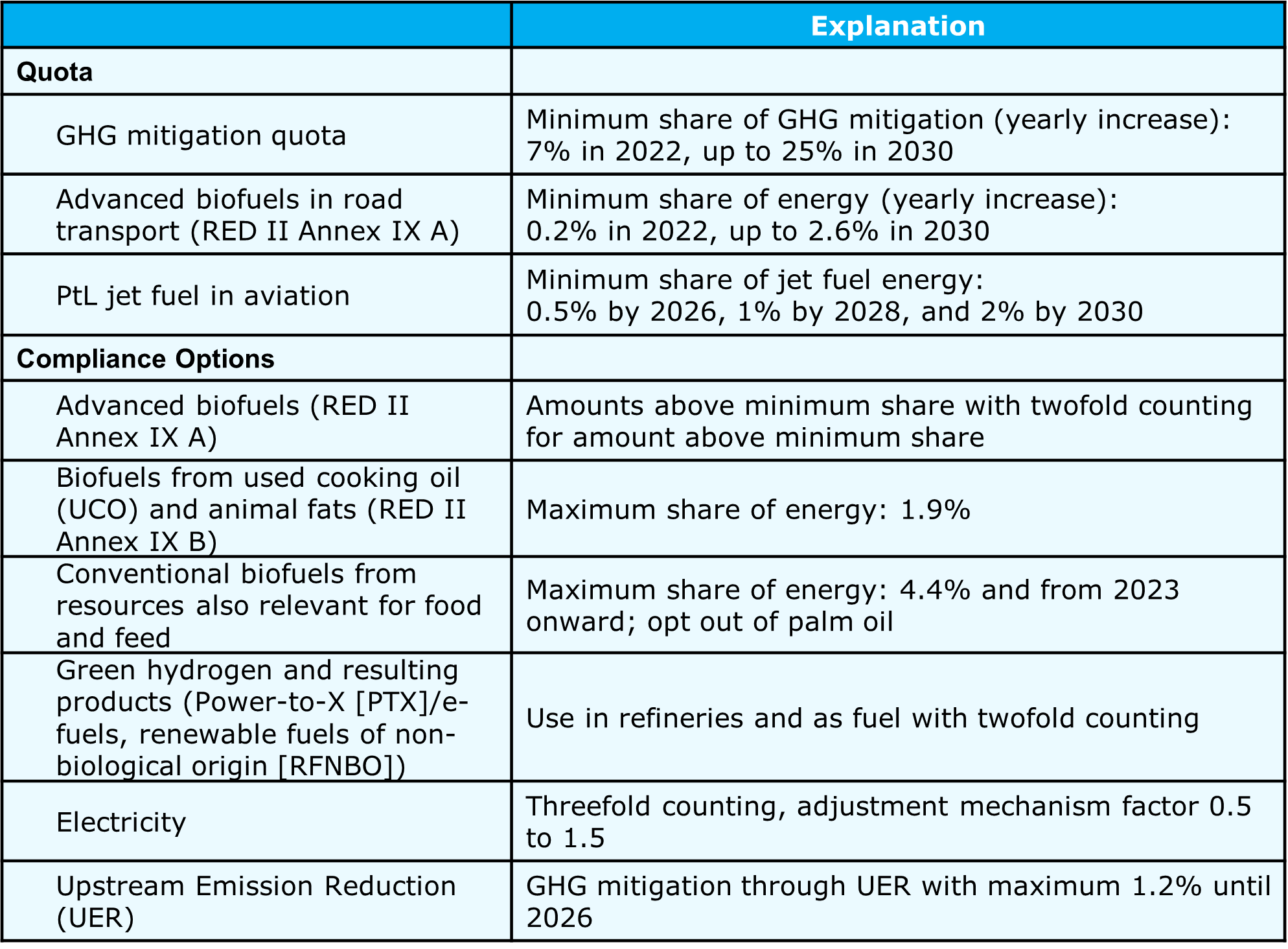

The main public drivers regarding policy in the transport sector remain the EU Renewable Energy Directive (RED II) and the Fuel Quality Directive (FQD), which are implemented by the Federal Emissions Control Act (BImSchG §37) and the GHG mitigation quota. The FQD is defined by EU Member States to implement GHG reduction targets for fuels on the market. By 2020, the target reduction was set for a 6% reduction, achieved through renewable fuels and including crediting of up to 1.2% upstream emission reductions (UER 2018). Fuel suppliers are obligated to report GHG emissions for the fuels they have introduced into the market.[12] RED II formally became national law in September 2021, continuing the GHG mitigation quota and increasing this quota incrementally from 7% in 2022 to 25% by 2030 (Table 1 provides a summary).[13]

The requirements outlined in the RED on sustainability and balancing GHG emissions are codified into national law by the biofuel sustainability ordinance (Biokraft-NachV)). The RED was revised in 2023, and took effect on November 20, 2023.[14] The revised RED sets an overall binding renewable energy target of at least 42.5% at EU level by 2030 — but aiming for 45%, requiring Germany to codify most of the directive’s provisions into national law within an 18-month period.[15] The German government elaborated a draft law accordingly which was approved in July 2024.[16]

Table 1. Summary GHG Mitigation Quota Until 2030 and Compliance Options in Germany

Importantly, the German government does not consider nuclear power a viable option; the last nuclear power plants were closed on April 15, 2023.[17] Germany’s position on nuclear power is unlike that of many European countries, where nuclear power is considered an essential energy source.[18] Similarly, the National Energy and Climate Plan (NECP) is an instrument of the EU to ensure that all EU Member States jointly work toward reaching EU climate goals. The national plans are monitored closely to ensure that every Member State is on the right track. Germany submitted a final update of the NECP 2021-2030 to the Commission in August 2024.[19]

To decarbonize the transport sector, high priority has recently been given to the enforcement of hydrogen and LNG infrastructure along the most important middle- and long-distance road networks and the expansion of the charging infrastructure for electric vehicles. The Federal Ministry for Economic Affairs and Climate Action (BMWK) invested EUR 62 million in the construction of three bunker vessels or FSRU (Floating Storage Regasification Unit) for LNG, which will later be used to refuel ammonia.[20] The project’s aim is to build a modern and sustainable infrastructure for maritime vessels. Likewise, the first German LNG terminal was inaugurated on December 17, 2022 in Wilhelmshaven. Overall, three LNG terminals are currently in use, while three LNG terminals are still under construction.[21] The capacity of all six units totals 30 billion m3.[22]

The application of hydrogen as a transport fuel is one of Germany’s main strategies to reach GHG quotas, as outlined in the National Hydrogen Strategy dated June 2020. By 2030, the EU expects to have capacity to meet a total hydrogen demand of 90 to 110 terawatt hours (TWh) (approximately 2.7 to 3.3 million metric tons), of which about 14 TWh (0.4 million metric tons) will be produced in Germany.[23] The strategy includes a strong focus on green hydrogen from electrolysis based on renewable electricity; biomass-based hydrogen is only considered on biotechnological routes or even as advanced biofuel in line with the RED II. In this respect, Germany’s strategy differs from the EU hydrogen strategy, which includes biomass as a renewable hydrogen source.[24] The strategy highlights the overall critical stance of the federal government toward using biomass for renewable fuel production. The strategy was revised in July 2023 and takes into account the increased level of ambition on the path to climate neutrality and the changing demands and challenges that have resulted from the Russian war of aggression. The main points of the strategy include accelerating the market ramp-up of hydrogen, ensuring sufficient availability of hydrogen and its derivatives, development of an efficient hydrogen infrastructure, and establishment of hydrogen applications in the sectors.[25]

The power-to-liquid (PtL) Roadmap, published in May 2021, outlines Germany’s efforts to expand the production of sustainable aviation fuel (SAF) from renewable energy sources.[26] The federal government, federal states, and industry representatives agreed in particular that electricity-based PtL kerosene from renewable energy sources will play a key role in making the aviation sector carbon-neutral and sustainable. Germany has set a goal of a minimum of 200,000 tonnes of PtL kerosene used in German aviation by 2030; this target is linked to the National Hydrogen Strategy.[27] The country intends to achieve the target through technological development, establishing uniform sustainability criteria, and supporting the market ramp-up.

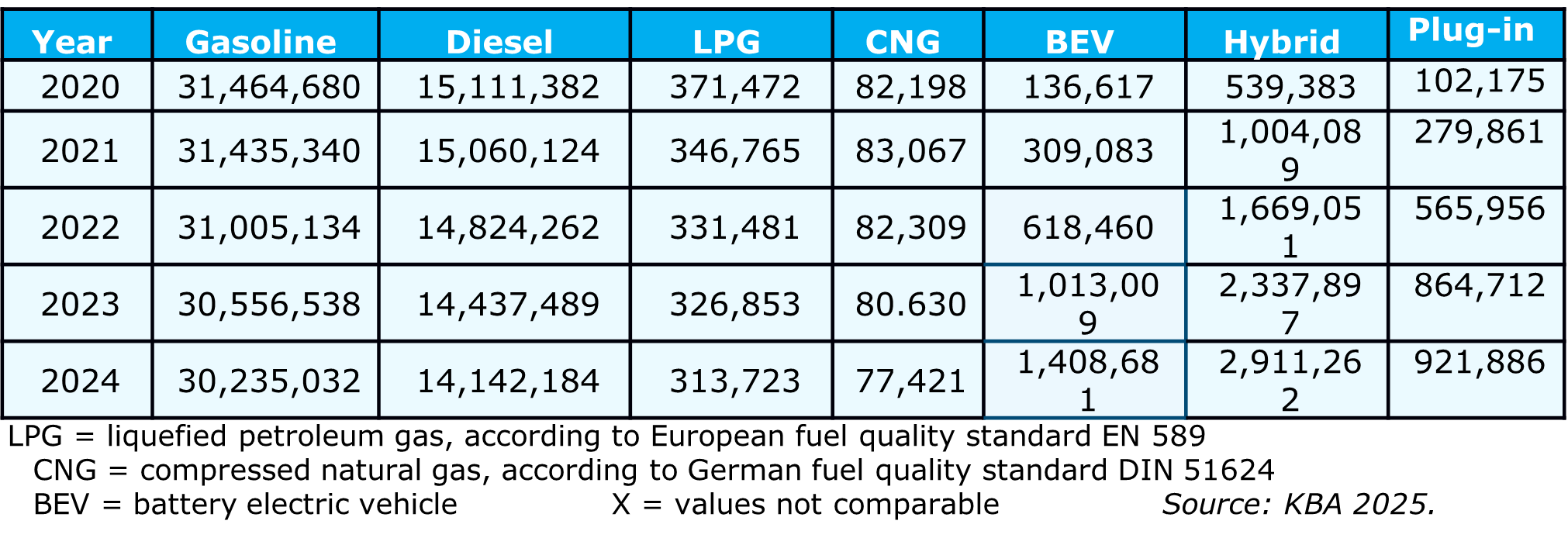

When it comes to on-road vehicles, on the other hand, all eyes are on electrification. The Trilogue’s October 2022 agreement to ban the sale of new combustion engine cars after 2035 illustrates a strong commitment to electric vehicles.[28] The federal government supports the agreement and believes that it will provide German industry the necessary planning security.[29] However, it seems that the European Commission is willing to re-evaluate the envisaged measures and time frame as Commission’s President Ursula von der Leyen declared that the Commission wants “to speed up work on the 2035 review, with full technology neutrality as a core principle” as well as to “propose a focused amendment to the CO2 Standards Regulation.”[30] This change of mindset might be influenced by the announcement of some car producers such as Porsche to focus more on combustion engines again instead of electric vehicles.[31] Thus, it fits into the picture that, despite a significant increase since 2017, the share of newly approved electric vehicles decreased dramatically in 2024.

In 2024, 380,609 BEVs (battery electric vehicle) were newly approved, which is a decrease of 27.4 % from 2023.[32] Taking into consideration electric vehicles powered by a plug-in hybrid engine or a fuel cell, 572,672 cars were newly approved in 2024. This is still a decrease of 18.2 % from the year before.[33] However, the share of cars with an alternatively powered drive (BEV, hybrid, plug-in hybrid, fuel cell, hydrogen, gas) is with 47.6 % comparably high among the newly approved cars in 2024.

Further, the available electric car series have increased in 2024 and more than 100 electric car series are available on the German market.[34] Interestingly, there is a wide selection of different electric models in the luxury segment,[35] indicating that car manufacturers are mostly aiming at consumers from a high socioeconomic class. As of February 2025, 69.1 million vehicles were registered in Germany as of January 1, 2024 (+1% compared to 2023), including 49.1 million passenger cars, 3.7 million trucks, 2.4 million towing vehicles, and 0,8 million buses.[36] Table 2 shows the number of passenger cars in Germany by fuel type for 2020–2024.

Table 2. Number of Passenger Cars in Germany by Fuel Type on January 1, 2020–2024

There are 125,408 “normal” and 36,278 high-speed publicly accessible charging points in Germany.[38] To make electric vehicles more attractive, the federal government introduced additional impetus for e‑mobility. The overall package consisted of temporary purchase incentives until the end of 2025, additional funds for the expansion of the charging infrastructure, and additional efforts in the public procurement of electric vehicles and tax measures, which ended in December 2023 — earlier than planned, due to shortages in the Climate Transformation Fund (KTF).[39]

While the political direction is clear, consumers offer various reasons for being hesitant to invest in non-combustion engine vehicles. Vehicle range and prices for refueling are the most important factors when purchasing a vehicle, thus limiting consumers’ willingness to purchase a vehicle that runs on renewable fuels.[40] Interestingly, in a study conducted by German Aerospace Center (DLR), the majority of respondents stated that every second service station in their region would need to offer renewable fuels for them to consider these fuels; in reality, 69% of respondents refuel at only 2–3 gas stations, revealing a discrepancy between their expectations and actual mobility behavior.

With regard to public transport, the federal government implemented measures including the introduction of a €49 monthly public transport ticket on May 1, 2023 (“Deutschlandticket” or “Germany, Ticket”), on buses, tramways, and metro and regional trains throughout Germany.[41] The ticket is a follow-up to the popular €9 ticket, which was available from June to August 2022, but is now available only through a subscription. After heavy debates about financing the ticket, it was decided that the ticket would be kept at the same price for 2024.[42] From January 2025, the price for the “Deutschlandticket” increased to €58 per month. Despite the increased prices, the number of subscribers has slightly increased to 13.5 million. Approximately 8% are new subscribers who have never used public transport before.[43] Thus, the ticket has not led to a major change in mobility behavior, but rewards those who already use public transport by making the monthly ticket significantly less expensive.

Advanced Motor Fuels Statistics

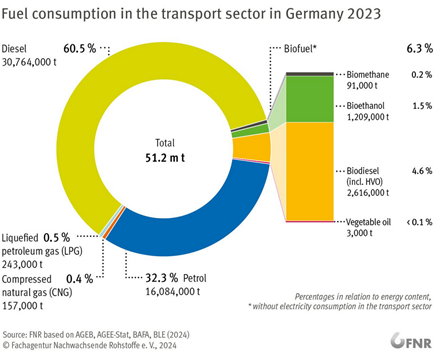

The consumption of fuels in Germany — primarily diesel, petrol and biofuels — totaled 51.2 Mt in 2023 (Figure 2).[44] To a minor extent, biomethane is used for compressed natural gas (CNG). The absence of incentives results in no market demand for E85 and pure biodiesel. Overall, energy crops and their use as fuel are limited, and need to be expanded in order to meet the climate goals.

Figure 2. Fuel Consumption in the Transport Sector in Germany in 2023[45]

In 2023, 3.9 million tons of certified biofuels have been placed in the market in Germany. The overall savings in GHG emissions resulting from the use of all biofuels was 12 million tons of CO2 equivalent, which equals 90% compared with fossil fuels.[46]

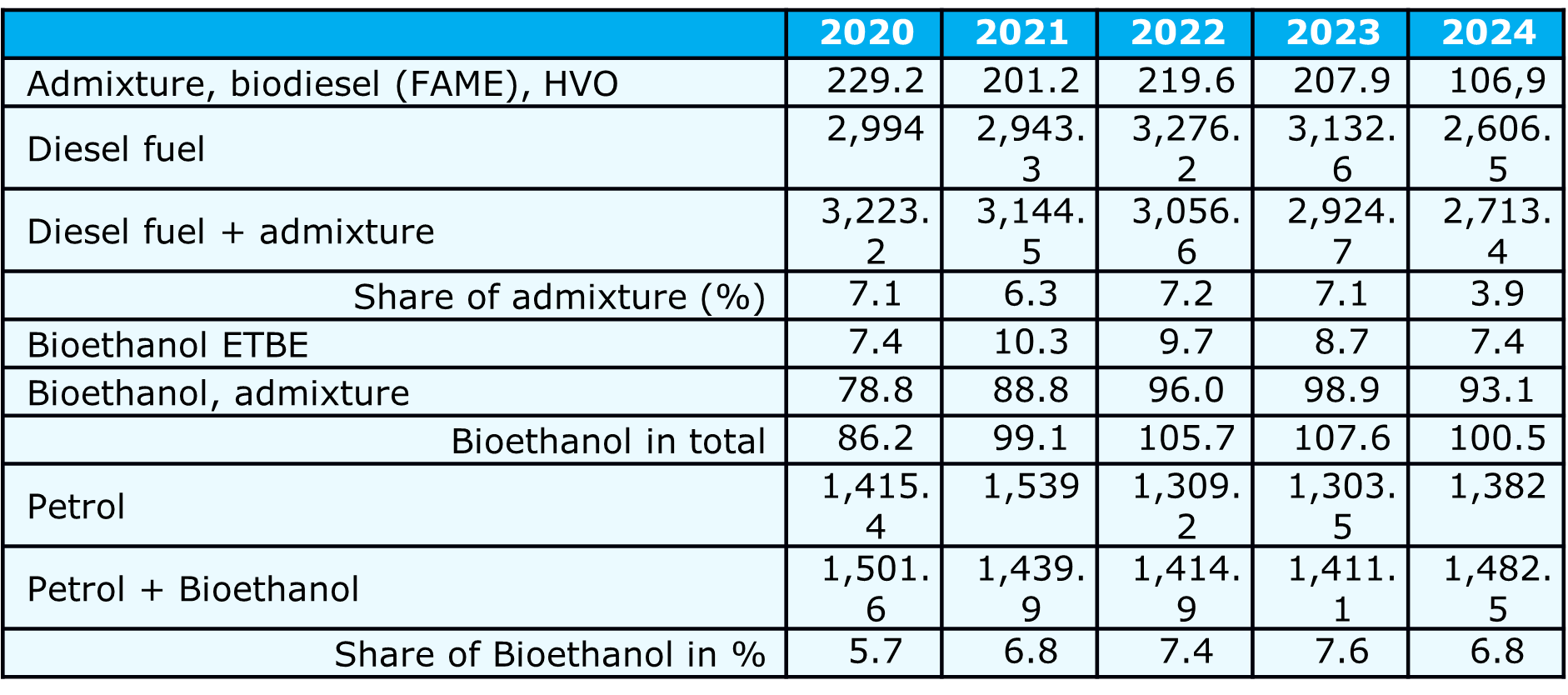

Table 3 shows the German domestic consumption of fuel and biofuel over the years since 2020. The figures refer to the fuel consumption in November of each year. It is clearly visible that the share of biodiesel admixture decreases significantly in November 2024. This trend can be observed all over the year 2024. The highest share of blending diesel fuel with biodiesel was reached in March 2024 (8.5 %) and then decreased month by month until the historic low of 3.9% since the introduction of the blending obligation in 2009. Further, the overall consumption of biodiesel and HVO decreased below 2 million tons from January to November 2024.[47] The reason for this decrease is seen in the double counting of biodiesel and HVO from certain waste categories towards the quota obligation and existing surplus GHG quotas.[48] This double counting could be addressed by the draft amendment of the Federal Emission Control Act, which will be elaborated by the new government in spring 2025.

Table 3. Domestic consumption of biofuels, 2020–2024 (as of November each year, in 1,000 tons) [49]

Research and Demonstration Focus

Public funding for alternative motor fuels on the national scale is supported by the Federal Ministry for Digital and Transport (BMDV) in the areas of National Innovation Programme Hydrogen and Fuel Cell Technology, NIPII, infrastructure, e-mobility, LNG, CNG, and jet fuel. Likewise, the Federal Ministry of Education and Research (BMBF) funds research through the “Kopernikus Projects” (P2X and SynErgie).[50] Since 2022, the BMBF funded three lighthouse projects with a total funding of EUR 700 million (USD 764 million): H2Giga, H2Mare, and TransHyDE.[51] The H2Giga flagship project aims to mass-produce electrolysers for the production and scale-up of hydrogen, while the H2Mare flagship project intends to produce hydrogen on the high seas, and the TransHyDE flagship project aims to develop a hydrogen transport infrastructure. The CARE-O-SENE project, funded with EUR 40 million, develops catalysts for green kerosene.[52]

The BMDV funded research on renewable fuels, with EUR 1.54 billion (USD 1.68 billion) available for 2021–2024, consisting of resources from the KTF and the National Hydrogen Strategy.[53] EUR 640 million (USD 698 million) were used for research and development (R&D) projects.[54] This funding program scope also includes advanced biofuels. The InnoFuels project intends to promote networking, further development of framework conditions for the ramp-up of electricity-based fuels, and advanced biofuels. Funding is also available at the state level; for example, Baden-Württemberg funds various R&D projects through its renewable fuels strategy.[55] The budget of the KTF has been cut by 60 billion Euros due to the decision of the Federal Constitutional Court in November 2023. For 2024 a total amount of 49 billion Euros was available for activities financed by the KTF. This resulted in less funding for R&D projects.[56] For example, R&D for electromobility will no longer be funded — a move that has been heavily criticized by universities and research institutes.[57]

Due to the early split of the federal government in November 2024 and the early elections to the German Parliament in February 2025, it is uncertain how things will develop and how the funding and research support will be shaped under new government. It might be assumed that climate change mitigation and adaptation and all the related topics as energy and transport transition will be in the focus of the new government and addressed accordingly. However, due to several national and global challenges, especially related to the further development in the United States as well as the formation of the new federal government in Germany, it is nearly unpredictable how thing will evolve and develop in the near future.

Outlook

The year 2024 has been one in which the threats and challenges of 2023 continued or even increased. The challenges on a national and international level have been mentioned earlier in this report. Thus, the support and funding of renewable energy sources and sustainable energy technologies are facing increasing competition with other urgent topics. In Germany, topics such as the economic crisis, migration, and national and international security are perceived as more and more important, especially against the backdrop of a Donald Trump presidency, the uncertain developments in Ukraine, and increasing nationalist tendencies in Germany and all over Europe. This becomes very clear when looking at the topics that were perceived as very important in the election campaigns in 2021 and 2025. While in 2021 climate change was perceived as most important,[58] in 2025 migration and inflation were perceived as the most important topics among German voters.[59]

This seems to indicate a shift of public and political perception and a turn towards topics such as security and economy that might displace or at least distract attention from topics such as climate change adaptation and mitigation activities or renewable sources. We cannot yet predict how things will develop. The old German Bundestag is currently debating a huge investment package of 500 billion euros for infrastructure and security/defense spending. But it is not clear whether it will be accepted since, for example, the Green Party argues that investments for climate protections and green transition are not addressed adequately.[60]

Taking all of this into consideration, it can be stated that 2025 will be an interesting but also a decisive year for Germany and Europe and for the topics of renewable energy source and green transition. Thus, next year’s country report promises to be interesting.

Additional Information Sources

- Bundesverband der deutschen Bioethanolwirtschaft

- Bundesverband Bioenergie

- Bundesverband Regenerative Mobilität

- Verband der Deutschen Biokraftstoffindustrie

- Fachagentur Nachwachsende Rohstoffe e.V.

- Nationale Organisation Wasserstoff- und Brennstoffzellentechnologie

- Deutsches Biomasseforschungszentrum gemeinnützige GmbH[61]

- eFuel Alliance

Major changes

- Split of the German government in November 2024, ending the coalition of Social Democrats, Liberals, and Greens, leading to advanced elections in February 2025. The elections resulted in a very likely coalition of Social Democrats (SPD) and Conservatives (CDU/CSU). The coalition negotiations indicated planned major investments in infrastructure and defence. Major changes related to energy and climate policies are not expected.

- Revision of the European Renewable Energy Directive and its transition into national law.

- End of subsidies for purchasing electric vehicles and other funding cuts arising from the decision of the Federal Constitutional Court in November 2023 related to the spending financed from the Climate Transformation Funds (KTF).

- Continuation of the subscription for public transport (“Deutschlandticket”).

Benefits of participation in AMF

Participation in AMF offers members access to global information and expertise around advanced transport fuels and exchange of experience in implementing solutions in member countries.

[1] The Federal Government, 2023, “The Climate and Transformation Fund 2024: Create relief, secure future investments, shape transformation,” https://www.bundesregierung.de/breg-en/news/agreement-budget-scholz-lindner-habeck-2249290, accessed 03.03.2025.

[2] The Federal Government, 2021, “Climate Change Act 2021: Intergenerational contract for the climate,”

https://www.bundesregierung.de/breg-de/themen/klimaschutz/climate-change-act-2021-1936846, accessed 03.03.2025.

[3] Federal Environment Agency, 2025: Emission Data 2024: https://www.umweltbundesamt.de/sites/default/files/medien/11867/dokumente/emissionsdaten_2024_-_pressehintergrundinformationen.pdf, accessed: 14.04.2025

[4] Federal Ministry for Economic Affairs and Climate Action, 2024, “Germany is on track for the first time with its 2030 climate goals,” https://www.bmwk.de/Redaktion/DE/Pressemitteilungen/2024/03/20240315-deutschland-bei-klimazielen-2030-erstmals-auf-kurs.html, accessed 20.03.2024.

[5] Umweltbundesamt, “Greenhouse Gas Projections 2024,” https://www.umweltbundesamt.de/sites/default/files/medien/11850/publikationen/thg-projektionen_2024_ergebnisse_kompakt.pdf, accessed 03.03.2025.

[6] Daily News, 2024,“Germany can achieve its climate target for 2030,” https://www.tagesschau.de/inland/innenpolitik/deutschland-klimaziele-erreichbar-100.html, accessed: 20.03.2024.

[7] The Federal Government, 2024, “Climate Action Programme 2030,” https://www.bundesregierung.de/breg-en/issues/climate-action/klimaschutzprogramm-2030-1674080, accessed 04.03.2025.

[8] The Federal Government, “Climate protection program 2030 to implement the climate protection plan 2050,” https://www.bundesregierung.de/resource/blob/974430/1679914/e01d6bd855f09bf05cf7498e06d0a3ff/2019-10-09-klima-massnahmen-data.pdf?download=1, accessed 04.03.2025.

[9] https://www.bundesregierung.de/breg-de/aktuelles/klimaschutzgesetz-2197410, accessed 10.03.2025.

[10] DBFZ (German Biomass Research Center), 2023, “Monitoring of renewable energies in transport,” https://www.dbfz.de/pressemediathek/publikationsreihen-des-dbfz/dbfz-reports/dbfz-report-nr-44, last accessed: 04.03.2025.

[11] Figure based on and updated: Schröder, Naumann (Eds.), 2023, DBFZ Report No.44, “Monitoring renewable energies in transport,” https://www.dbfz.de/fileadmin/user_upload/Referenzen/DBFZ_Reports/DBFZ_Report_44_EN.pdf, last accessed: 04.03.2025.

[12] DBFZ, 2021, “Further development of the German greenhouse gas reduction quota,” https://www.dbfz.de/fileadmin/user_upload/Referenzen/Statements/Hintergrundpapier_Weiterentwicklung_THG-Quote.pdf, accessed 04.03.2024.

[13] Federal Ministry of Justice, “Law to protect against harmful environmental effects caused by air pollution, noise, vibrations and similar processes.” https://www.bgbl.de/xaver/bgbl/start.xav?startbk=Bundesanzeiger_BGBl&start=//*[@attr_id=%27bgbl121s4458.

pdf%27]#__bgbl__%2F%2F*%5B%40attr_id%3D%27bgbl121s4458.pdf%27%5D__1646058705951, accessed 04.03.2024.

[14] European Commission, “Renewable Energy Directive,” https://energy.ec.europa.eu/topics/renewable-energy/renewable-energy-directive-targets-and-rules/renewable-energy-directive_en, accessed 04.03.2024.

[15] Ibid.

[16] Federal Ministry for Economic Affairs and Climate Action, “Federal Government speeds up approval procedure for on-shore Wind Energy and Solar Energy,” https://www.bmwk.de/Redaktion/DE/Pressemitteilungen/2024/07/20240724-genehmigungsverfahren-windenergie-an-land-solarenergie.html, accessed 03.03.2025.

[17] The Federal Government, 2022, “Energy supply security is key,”

https://www.bundesregierung.de/breg-de/schwerpunkte/klimaschutz/ausstieg-aus-der-kernkraft-2135796, accessed 04.03.2024.

[18] EuroNews, 2023, “Nuclear energy in Europe: Who is for and against it and why?” https://www.euronews.com/business/2023/12/23/nuclear-energy-in-europe-who-is-for-and-against-it-and-why, accessed 04.03.2024.

[19] https://commission.europa.eu/publications/germany-final-updated-necp-2021-2030-submitted-2024_en, accessed 10.03.2025.

[20] Federal Ministry for Economic Affairs and Climate Action, “Habeck hands over funding notices: €62 million for the construction of three innovative LNG bunker vessels,” https://www.bmwk.de/Redaktion/EN/Pressemitteilungen/2022/12/20221223-habeck-hands-over-funding-notices-eur62-million-for-the-construction-of-three-innovative-lng-bunker-vessels.html, accessed 04.03.2024.

[21] Federal Ministry for Economic Affairs and Climate Action, “The Federal Ministry for Economic Affairs and Climate Action presents a report on the plans for floating and fixed LNG terminals and their capacities,” https://www.bmwk.de/Redaktion/EN/Pressemitteilungen/2023/03/20230303the-federal-ministry-for-economic-affairs-and-climate-action-presents-a-report-on-the-plans-for-floating-and-fixed-lng-terminals-and-their-capacities.html, accessed 08.05.2024.

[22] NDR, “How much LNG arrives in Germany?” https://www.ndr.de/nachrichten/info/LNG-Wie-viel-Fluessigerdgas-kommt-derzeit-in-Deutschland-an,lng632.html, accessed 03.03.2025.

[23] DBFZ, 2022, “Hydrogen from biomass,” https://www.dbfz.de/pressemediathek/publikationsreihen-des-dbfz/dbfz-reports/dbfz-report-nr-46, accessed 04.03.2024.

[24] Ibid.

[25] Federal Ministry for Economic Affairs and Climate Action, 2023, “Update of the National Hydrogen strategy” https://www.bmwk.de/Redaktion/DE/Wasserstoff/Downloads/Fortschreibung.pdf?__blob=publicationFile&v=4, accessed 04.03.2025.

[26] The Federal Government, “PtL roadmap: Sustainable aviation fuel from renewable energy sources for aviation in Germany,” https://bmdv.bund.de/SharedDocs/DE/Anlage/G/ptl-roadmap-englisch.pdf?__blob=publicationFile, accessed 04.03.2025.

[27] Ibid.

[28] News of the European Parliament, 2022, “Deal confirms zero-emissions target for new cars and vans in 2035,” https://www.europarl.europa.eu/news/en/press-room/20221024IPR45734/deal-confirms-zero-emissions-target-for-new-cars-and-vans-in-2035, accessed 04.03.2024.

[29] German Parliament, “Answer of the federal government to the small question from the CDU/CSU faction,” https://dserver.bundestag.de/btd/20/050/2005047.pdf, accessed 04.03.2024.

[30] European Commission, 2025: Press statement by President von der Leyen on the Strategic Dialogue on the Future of the Automotive Industry, https://ec.europa.eu/commission/presscorner/detail/en/statement_25_656, accessed 04.03.2025.

[31] Springer Professional, 2025: “Porsche is Focussing More on Combustion Engines Again,” https://www.springerprofessional.de/en/automotive-industry/automotive-manufacturing/porsche-is-focusing-more-on-combustion-engines-again/50667308, accessed 04.03.2025.

[32] Kraftfahrt-Bundesamt KBA (Motor Transport Authority), 2025: “New Approvals of passenger cars in 2024,” https://www.kba.de/DE/Presse/Pressemitteilungen/AlternativeAntriebe/2025/pm03_2025_Antriebe_12_24_komplett.html, accessed 04.03.2025.

[33] Ibid.

[34] ADAC, 2025, “Overview: Which electric cars are currently available to buy?” https://www.adac.de/rund-ums-fahrzeug/elektromobilitaet/kaufen/elektroautos-uebersicht/, accessed 27.02.2025.

[35] Ibid.

[36] Kraftfahrt-Bundesamt KBA (Motor Transport Authority), 2025: “Annual balance 2024,”

https://www.kba.de/DE/Statistik/Fahrzeuge/Bestand/Jahrebilanz_Bestand/fz_b_jahresbilanz_node.html, accessed: 05.03.2025.

[37] Kraftfahrt-Bundesamt KBA (Motor Transport Authority), 2025: “Passenger cars on January 1, 2024 according to selected characteristics,” https://www.kba.de/DE/Statistik/Fahrzeuge/Bestand/Jahrebilanz_Bestand/2024/2024_b_jahresbilanz_tabellen.html;jsessionid=B8BE4D5B03C5B663B1964163541F5521.live21301?nn=3532350&fromStatistic=3532350&yearFilter=2024&fromStatistic=3532350&yearFilter=2024, accessed 05.03.2025.

[38] Federal Network Agency, “Electromobility: Public charging infrastructure,”

https://www.bundesnetzagentur.de/DE/Sachgebiete/ElektrizitaetundGas/Unternehmen_Institutionen/E-Mobilitaet/start.html, accessed 04.03.2025.

[39] Federal Office of Economics and Export Control, https://www.bafa.de/DE/Energie/Energieeffizienz/Elektromobilitaet/Neuen_Antrag_stellen/neuen_antrag_stellen.html, accessed 04.03.2025.

[40] Dr. Jipp, DLR, Presentation at “Fuels of the Future Conference” in Berlin on 23 January 2023.

[41] The Federal Government, “One ticket for all of Germany,”

https://www.bundesregierung.de/breg-de/aktuelles/deutschlandticket-2134074, accessed 04.03.2025.

[42] Ibid.

[43] VDV, “Deutschland Ticket: the biggest fare revolution in public transport,”

https://www.vdv.de/deutschlandticket.aspx#:~:text=Mehr%20als%2011%20Millionen%20verkaufte%20Deutschland%2DTicket%2DAbos&text=In%20den%20Sommerferienmonaten%20Juli%20und,Nutzerinnen%20und%20Nutzer)%20weiter%20gestiegen, accessed: 04.03.2024.

[44] FNR, “Fuel consumption in Germany,” https://mediathek.fnr.de/grafiken/daten-und-fakten/bioenergie/biokraftstoffe/kraftstoffverbrauch-in-deutschland.html, accessed 04.03.2024.

[45] Federal Office for Economic Affairs and Export Control; BAFA et al. (Federal Statistics Office [Destatis], DVFG [German LPG Association], the Federal Ministry of Finance [or BMF], Agency for Renewable Resources [Fachagentur Nachwachsende Rohstoffe e.V., or FNR]), 2025.

[46] Federal Agency for Agriculture and Food “2023 Evaluation and Experience Report,”

https://www.ble.de/SharedDocs/Downloads/DE/Klima-Energie/Nachhaltige-Biomasseherstellung/Evaluationsbericht_2023.pdf?__blob=publicationFile&v=2, accessed 05.03.2025.

[47] UFOP, 2025: “Biodiesel admixture reaches all-time low,” https://www.ufop.de/english/news/biodiesel-admixture-reaches-all-time-low/, accessed 07.03.2025.

[48] Ibid.

[49] Federal Office for Economic Affairs and Export Control (Bafa), 2025: “Official Mineral Oil Data,” https://www.bafa.de/SiteGlobals/Forms/Suche/Infothek/Infothek_Formular.html?nn=8064038&submit=Senden&resultsPerPage=100&documentType_=type_statistic&templateQueryString=Amtliche+Daten+Mineral%C3%B6ldaten&sortOrder=dateOfIssue_dt+desc, accessed 05.03.2025

[50] https://www.kopernikus-projekte.de/en/home, accessed 06.03.2025.

[51] Federal Institute for Education and Research, “Welcome to Hydrogen Flagship Projects,” https://www.wasserstoff-leitprojekte.de/home, accessed 04.03.2024.

[52] CARE-O-SENE, “Research for a green future: CARE-O-SENE – Catalyst Research for Sustainable Kerosene,” https://care-o-sene.com/en/, accessed 04.03.2024.

[53] Federal Agency for Digital Affairs and Transport, “Climate protection in transport – alternative fuels,”

https://bmdv.bund.de/DE/Themen/Mobilitaet/Klimaschutz-im-Verkehr/Alternative-Kraftstoffe/alternative-kraftstoffe.html, accessed 04.03.2024.

[54] Federal Ministry for Digital and Transport, “From development to market ramp-up: Ministry launches new funding concept for renewable fuels,” https://bmdv.bund.de/SharedDocs/DE/Artikel/G/Klimaschutz-im-Verkehr/neues-foerderkonzept-erneuerbare-kraftstoffe.html, accessed 04.04.2024.

[55] Baden-Wuerttemberg “International cooperation on climate-neutral fuels,”

https://www.baden-wuerttemberg.de/de/service/presse/pressemitteilung/pid/internationale-zusammenarbeit-bei-klimaneutralen-kraftstoffen, accessed 04.03.2024.

[56] Federal Ministry for Economic Affairs and Climate Action, 2023, “The Climate and Transformation Fund 2024: Create relief, secure future investments, shape transformation,”

https://www.bmwk.de/Redaktion/DE/Meldung/2023/20231221-haushalt-einigung-ktf-2024.html, accessed 04.03.2024.

[57] “Continue practice-oriented research on electromobility,” https://www.oeko.de/fileadmin/oekodoc/Offener-Brief_Bundesregierung_Haushaltskuerzungen_Elektromobilitaet.pdf, accessed 04.03.2024.

[58] Konrad Adenauer Stiftung, 2021: “Bundestag Election in Germany on 26 September 2021,” p. 8 https://www.kas.de/documents/252038/11055681/Bundestag+Election+in+Germany+on+26+September+2021.pdf/11c8cee6-4819-40aa-69c5-81e3b8da1e08?t=1633597927008, accessed 12.03.2025.

[59] Deutsche Welle, “DW; 2025: German election: migration and economy key issues,”

https://www.dw.com/en/immigration-and-economy-key-issues-in-german-election/a-71702813, accessed 13.03.2025

[60] Financial Times, “Germany´s Greens vow to block Friedrich Merz´s flagship spending package,”

https://www.ft.com/content/b89519e8-1008-408b-80fd-b8ddbcad15d7, accessed 13.03.2025.

[61] DBFZ Report No. 44, “Monitoring renewable energies in transport,” https://www.dbfz.de/en/press-media-library/publication-series/dbfz-reports, accessed 04.03.2024.