Advanced Motor Fuels in Canada

Drivers and Policies

Clean Fuel Regulations

Registered on June 21, 2022, the Clean Fuel Regulations (CFR) require producers and importers of gasoline or diesel to reduce the carbon intensity (CI) of the fuels they produce in, and import into, Canada for use in Canada. The regulations establish a credit market in which the annual requirement to reduce carbon intensity can be met through three main categories of credit-creating actions:

- Undertaking projects that reduce the life-cycle carbon intensity of liquid fossil fuels,

- Supplying low-carbon-intensity fuels, and

- Supplying fuel or energy to advanced vehicle technology.

The annual CI reduction requirements for gasoline and diesel came into force on July 1, 2023, starting at 3.5 grams of carbon dioxide equivalent (CO2e) per unit of energy and increasing to 14 grams in 2030. Once fully implemented, the CFR will help cut up to 26.6 million tonnes (Mt) of greenhouse gas (GHG) pollution in 2030.

Last June, ECCC released its first CFR Credit Market Report, which presented data on the compliance credit market. Credit creation data, number of credit transfers, and average price of credit transfers are provided for the 2022 and 2023 compliance periods (June 21, 2022, to December 31, 2023), and credit transfer data are presented for transactions completed from June 30, 2023, to May 31, 2024. The report first highlights key aspects of the credit market, such as credit prices and number of transfers, and then presents more details on credit creation by compliance category.

In combination with the Government of Canada’s $1.5 billion Clean Fuels Fund, the CFR creates incentives for increased domestic production of low-carbon-intensity fuels. Budget 2024 announced the retooling of the Clean Fuels Fund and its extension to March 31, 2030. Support will be available to de-risk capital investments and studies that expand Canada’s clean fuel production capacity, and to address gaps and alignment in codes, standards, and regulations.

Along with the federal policy, Canada has provincial renewable fuel and low-carbon fuel requirement regulations that prescribe specific renewable fuels volumes and carbon intensity.[1] For example, Ontario[2] and Quebec[3] require 10% renewable content in gasoline, which will be increased to 15% in 2030. British Columbia’s Low Carbon Fuel Standard mandates a minimum 5% annual average renewable fuel content in gasoline and 8% renewable fuel content in diesel. The Standard also requires fuel suppliers to reduce the average CI of their fuels annually to achieve a 30% reduction by 2030.[4] British Columbia has also implemented a minimum blending requirement in jet fuel, starting at 1% vol in 2028 and increasing to 3% vol by 2030.[5]

Renewable-fuels-related Standards

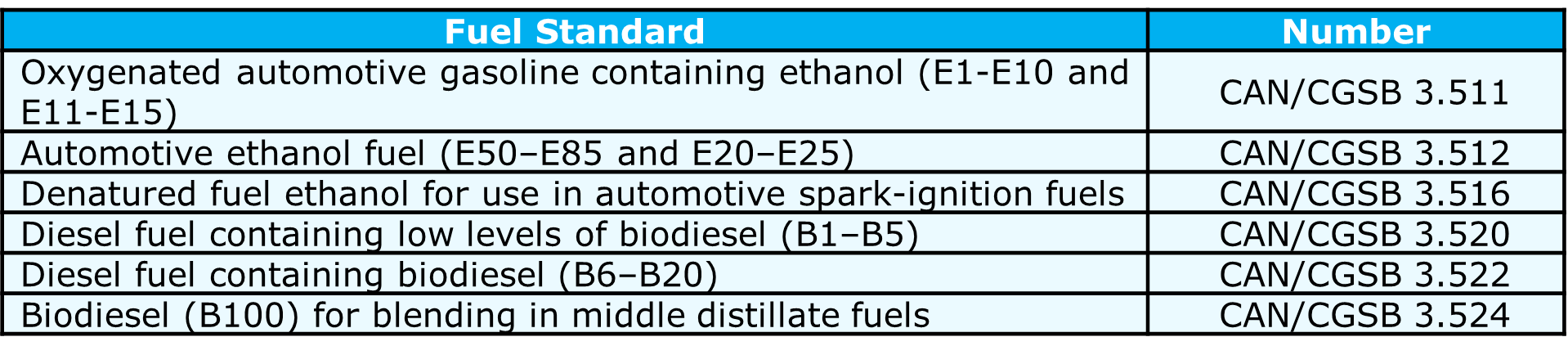

The Canadian General Standards Board (CGSB) is responsible for developing fuel and renewable fuel quality standards through consensus with the public and private sectors (see Table 1).

Table 1. CGSB Renewable Fuel-Quality-Related Standards

Canada’s Climate Plans and Targets

The 2016 Pan-Canadian Framework on Clean Growth and Climate Change (PCF) is Canada’s first-ever national climate plan. The PCF was developed with provinces and territories, and in consultation with Indigenous peoples. The objective is to meet Canada’s emission reduction targets, grow the economy, and build resilience to a changing climate. The plan includes a pan-Canadian approach to pricing carbon pollution and measures to achieve reductions across all sectors of the economy.

In March 2022, the Government of Canada introduced Canada’s 2030 Emissions Reduction Plan, which builds on the efforts of the PCF. The plan provides a sector-by-sector roadmap for Canada to reach its emissions reduction target of 40% below 2005 levels by 2030 and net-zero emissions by 2050.

The Canadian Net-Zero Emissions Accountability Act, which became law in June 2021, formalizes Canada’s commitment to achieve net-zero emissions by 2050. The Net-Zero Advisory Body (NZAB) engages Canadians and provides independent advice to the Minister of Environment and Climate Change with respect to achieving Canada’s net-zero emissions goal.

Greenhouse Gas Emission Regulations

In 2021, Canada completed a mid-term evaluation of the appropriateness of its standards for model years 2022 to 2025 under the “Passenger Automobile and Light Truck GHG Emission Regulations.” Further, Canada is working with both the United States and the State of California to develop future light-duty vehicle (LDV) GHG regulations that align with the most stringent LDV GHG tailpipe regulations in the United States, whether at the federal or state level. The 2030 Emissions Reduction Plan makes a commitment to develop regulations to make 100% of new LDVs zero-emissions vehicles (ZEVs) by 2035, with interim targets of at least 20% in 2026 and at least 60% in 2030.

Canada published the Regulations Amending the Passenger Automobile and Light Truck Greenhouse Gas Emission Regulations on December 20, 2023. These amendments require auto manufacturers and importers to meet increasingly stringent annual ZEV targets, including the targets specified in the Emissions Reduction Plan (20% for the 2026 model year, 60% by 2030, and 100% by 2035). The next phase of Canadian emission standards will be informed by the release of the U.S. Environmental Protection Agency’s (EPA’s) final rulemaking entitled “Multi-Pollutant Emissions Standards for Model Years 2027 and Later Light-Duty and Medium-Duty Vehicles.”

Canada’s 2030 Emissions Reduction Plan also includes a commitment to further improve the efficiency of heavy-duty vehicle standards beyond 2025 by aligning with the most stringent standards in North America, whether at the U.S. federal or state level. Further, the Government of Canada committed to (1) develop a medium- and heavy-duty vehicle (MHDV) ZEV regulation requiring 100% of MHDVs sold to be ZEVs by 2040 for a subset of vehicle types — with interim 2030 regulated sales requirements that would vary by vehicle category based on feasibility — and (2) explore interim targets for the mid-2020s.

Canada also developed a regulatory framework for the transition of the MHDV sector to ZEVs to reduce emissions. The framework included a technical readiness assessment and consultations with industry. Canada maintained awareness of strategies undertaken in other jurisdictions, including individual provinces and the United States. Canada is also examining several proposed EPA rulemakings — the “Greenhouse Gas Emissions Standards for Heavy-Duty Vehicles — Phase 3” and “Multi-Pollutant Emissions Standards for Model Years 2027 and Later Light-Duty and Medium-Duty Vehicles” — in accordance with its commitment to align with the most stringent emission standards in North America.

Hydrogen Strategy for Canada

Since 2020, Natural Resources Canada (NRCan) has engaged with stakeholders, government, and Indigenous partners to create the Hydrogen Strategy for Canada, which seeks to leverage Canada’s hydrogen through various pathways, including fuel for transportation. The strategy includes hydrogen end-use opportunities for LDVs, buses, trucks and equipment, rail, marine, and aviation. In May 2024, after 3 years of engagement, the Hydrogen Strategy for Canada: Progress Report was released as a strategic directional document. One key finding in the Progress Report indicated that hydrogen used in transport could range from 12% to 35% of the transport sector’s energy use in 2050 and up to 18% of energy consumption in the transportation industry.

Advanced Motor Fuels Statistics

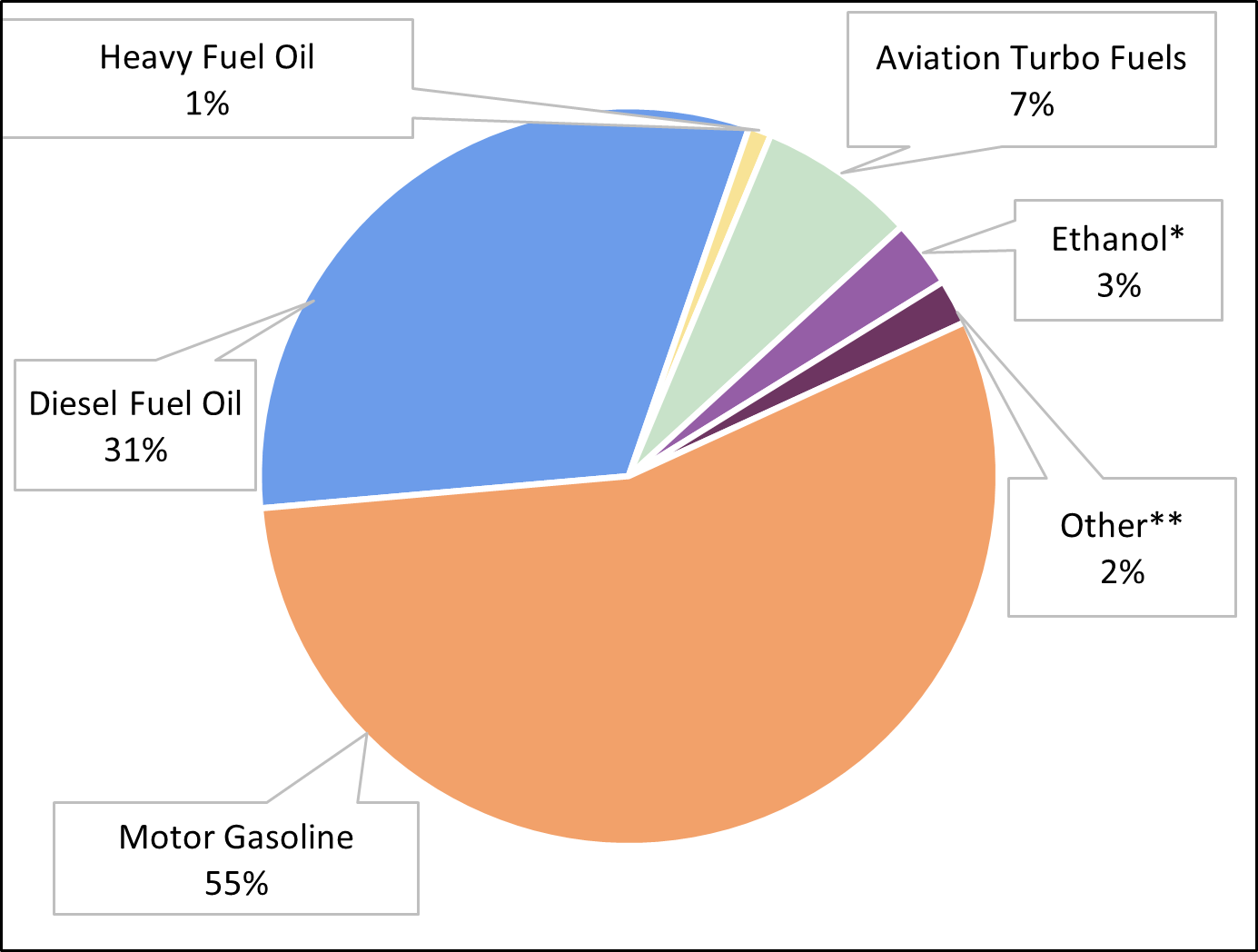

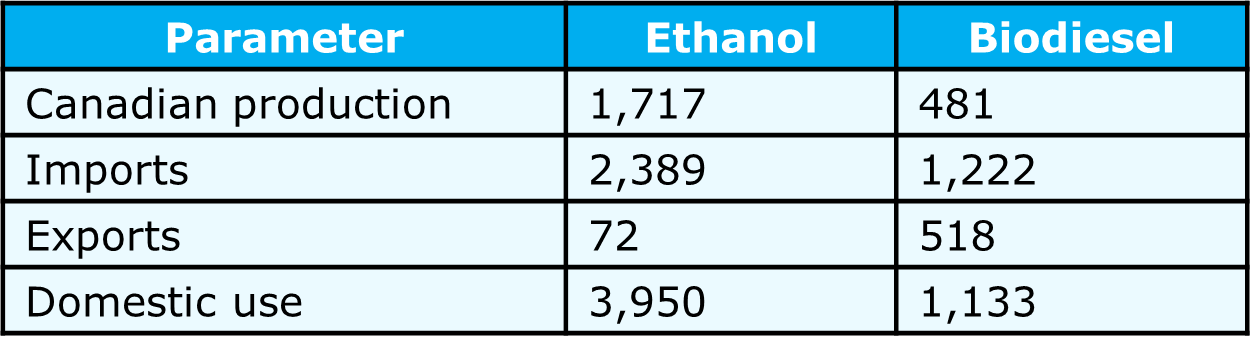

Figure 1 shows energy use by fuel type in 2021 for transportation in Canada. Table 2 lists supply and demand for ethanol and biodiesel in 2023.

Figure 1. Fuel Mix of the Canadian Transportation Sector, 2021

*Ethanol proportion is estimated on the basis of production data.

**Includes electricity, natural gas, biodiesel fuel oil, light fuel oil, aviation gasoline, and propane.

Table 2. Canadian Supply and Demand of Biofuels, 2023 (in millions of liters)

Transportation GHG emissions (from passenger, freight, and other forms of transport) increased 4% from 2020 to 2022, reflecting a rebound from the pandemic. Despite the increase, transportation emissions were 8% below their pre-pandemic (2019) level.

Research and Demonstration Focus

ecoTECHNOLOGY for Vehicles (eTV) Program

The eTV Program, conducted through Transport Canada’s Innovation Centre, tests the safety, environmental impact, and driving performance of new technologies for passenger cars and heavy-duty trucks. The program investigates the performance of new technologies for advanced engines and transmissions, renewable fuels, hybrid and electric vehicles, hydrogen and fuel cell vehicles, and connected and automated vehicles.

Program of Energy Research and Development (PERD)

NRCan’s PERD supports energy R&D conducted by the federal government and is designed to ensure a sustainable energy future for Canada. Key research areas include knowledge and technologies that will help reduce the carbon footprint of fuels, improve the efficiency of vehicles, electrify transport, and reduce emissions from transportation sources.

Electric Vehicle and Alternative Fuel Infrastructure Deployment Initiative (EVAFIDI)

Through NRCan’s EVAFIDI program, funds are invested into public infrastructure to encourage the transition to low- or zero-emission vehicles. As of 2024, a total of 1,072 electric, 6 hydrogen, and 14 natural gas stations have opened in Canada.

Zero Emissions Vehicle Infrastructure Program (ZEVIP)

NRCan’s ZEVIP is an initiative to address the lack of charging and refueling stations in Canada by increasing the availability of localized charging and hydrogen refueling opportunities. The program provides opportunities for owners/operators of ZEV infrastructure, delivery organizations, and Indigenous organizations.

Energy Innovation Program (EIP): On-Road Transportation Decarbonization

NRCan’s On-Road Transportation Decarbonization program conducts research, development, and demonstration (RD&D) projects that address barriers to the uptake of zero-emission MHDVs, innovative infrastructure solutions to support ZEVs, and transportation system efficiency. Projects funded under the EIP focus on influencing the pace and direction of energy system transformation and targeting the most impactful technologies to maximize environmental and economic outcomes.

Strategic Innovation Fund (SIF)

The SIF, managed by Innovation, Science and Economic Development Canada, provides support to Canadian businesses investing in innovation and to industry efforts to accelerate the production of low- and zero-emission vehicles and improve the battery supply chain.

Canada’s Aviation Climate Action Plan

Canada’s Aviation Climate Action Plan includes R&D to support Canada’s commitments to achieve net-zero emissions by 2050. More than 60 airlines operating in Canada participate in the Canadian Council for Sustainable Aviation Fuels, which brings together industry and government to develop a competitive roadmap for Canadian-made sustainable aviation fuels.

Green Freight Program (GFP)

The GFP, funded through NRCan, will help fleets reduce their fuel consumption and GHG emissions through fleet energy assessments, fleet retrofits, engine repowers, logistical best-practice implementation, and the purchase of low-carbon vehicles. Fleet modernization is a component of the program and includes vehicle repowering, purchases of low-carbon alternative-fuel vehicles, and implementation of logistical best practices.

The Green Shipping Corridor Program (GSCP)

Transport Canada’s GSCP provides funding for projects that contribute to the establishment of green shipping corridors and the decarbonization of Canada’s marine sector. One area of focus is building the capacity of Canadian vessel owners/operators to identify, plan, and incorporate next-generation low-carbon and zero-emission ship technology and marine fuels into their vessel operations.

Low-carbon Fuel Procurement Program (LCFPP)

Within the Greening Government Fund, the LCFPP will provide funding to federal air and marine fleet departments for the purchase of low-carbon fuels. This program supports the purchase of approximately 200 million litres of low-carbon fuels by the end of fiscal year 2030–31.

Outlook

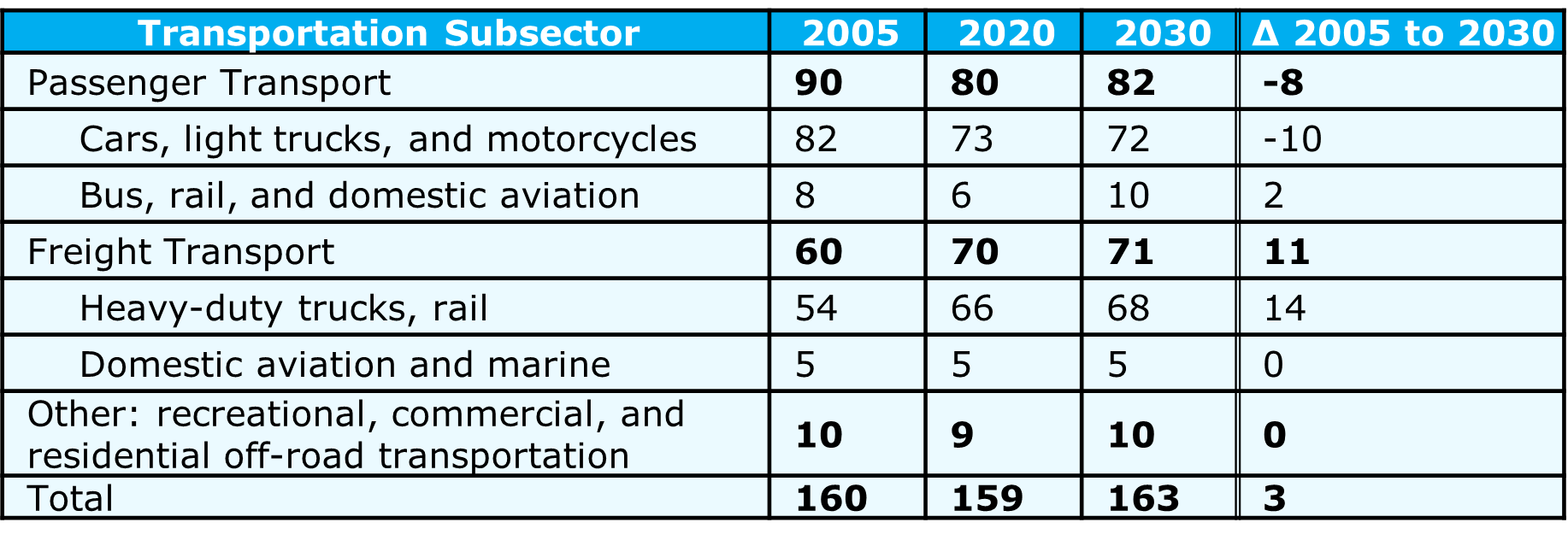

As depicted in Table 3, the Canadian transportation sector comprises several distinct subsectors, each exhibiting different trends during the projected period. GHG emissions from cars, trucks, and motorcycles are projected to decrease by 10 Mt between 2005 and 2030, while those for heavy-duty trucks and rail are projected to increase by 14 Mt.

Table 3. Transportation: GHG Emissions (Mt CO2e)

This table includes projections with additional measures using Environment and Climate Change Canada’s Energy, Emissions, and Economy Model for Canada.

[1] Navius Research, 2024, Biofuels in Canada 2024 Annual Report, work sponsored by Advanced Biofuels Canada.

[2] Ontario, Canada, Cleaner transportation fuels.

[3] Gouvernement du Québec, Ethanol and biodiesel.

[4] Province of British Columbia, Renewable and Low Carbon Fuels.

[5] Victoria, British Columbia, Low Carbon Fuels (General) Regulation.