Advanced Motor Fuels in India

Drivers & Policies

India is the third-largest consumer of oil in the world. India also ranks as the world’s second-largest net crude importer and sixth-largest petroleum product exporter, and the country is forecast to be the single largest source of global oil demand growth from 2023 to 2030, narrowly ahead of China. Underpinned by strong economic and demographic growth, India is on track to post an increase in oil demand of almost 1.2 million barrels per day (mb/d) over the forecast period, accounting for more than one third of the projected 3.2-mb/d global gains.

India’s economy is projected to grow at an average annual rate of 4.9% per year in 2023 and 2050. According to the IEA World Energy Outlook 2024, during this period, primary energy is expected to increase significantly — by 55% under Stated Policies Scenario (STEPS) and by 36% under the Announced Pledges Scenario (APS). As result of this robust growth, India’s share in global primary energy consumption rises from around 7% in 2023 to approximately 10% by 2050 in both scenarios. Coal’s share in the energy mix is projected to decline sharply, from 46% in 2023 to 27% by 2050 under STEPS, and even further to 16% under APS. In contrast, renewable energy sees substantial growth, with compound annual growth rates (CAGR) of 5.3% and 6.43% under STEPS and APS, respectively. By 2050, renewables emerge as the largest source of primary energy, with their share rising dramatically from 15% in 2023 to 38% under STEPS and 58% under APS. Electricity generation also sees a major boost — nearly 2.9 times the 2023 level under STEPS and approximately 3.5 times under APS by 2050. Solar and wind power together will account for nearly 94% of that growth. Hydrogen, which starts from an almost negligible base, is expected to grow to 65 PJ under STEPS and 597 PJ under APS in terms of total final consumption.

Currently, India imports approximately 88% of its crude oil and 51% of its natural gas requirements. Growing concern about the nation’s dependence on imported fuel, in tandem with environmental pollution issues, has driven India’s need for alternative fuels. India plans to reduce import dependency in the oil and gas sectors by adopting a five-pronged strategy: increasing domestic production, adopting biofuels and renewables, establishing energy-efficiency norms, improving refinery processes, and implementing demand substitution.

Since 2014, the Indian government has undertaken multiple interventions to promote biofuels through structured programs such as the Ethanol Blended Petrol (EBP) Programme; Biodiesel Blending in Diesel Programme; and SATAT (Sustainable Alternative Towards Affordable Transportation), an initiative for promotion of compressed biogas (CBG). India introduced a National Policy on Biofuels in 2018 (subsequently amended in June 2022) that aims to achieve 20% blending of ethanol in petrol by ethanol supply year (ESY) 2025–26 and 5% blending of biodiesel in diesel by 2030. To enhance use and adoption of CBG, phased mandatory CBG obligations in compressed natural gas (CNG) (for transport) and piped natural gas (PNG) (for domestic use) in the city gas distribution (CGD) sector would begin in financial year (FY) 2025–26. The CBG obligations will be 1%, 3%, and 4% of total CNG [Transport(T)]/PNG [Domestic (D)] consumption for FYs 2025–26, 2026–27, and 2027–28, respectively. Beginning in 2028–2029, the CBG obligation will be 5%. The government has also set targets of 1%, 2%, and 5% blending of sustainable aviation fuel (SAF) in aviation turbine fuel (ATF) effective from 2027, 2028, and 2030, respectively, initially for international flights.

The major feature of India’s biofuels policy is the categorization of such fuels as either “basic biofuels” (e.g., first-generation [1G] ethanol, biodiesel) and “advanced biofuels” (e.g., 2G ethanol, drop-in fuels) to expand the scope of raw material for ethanol production. To promote a hydrogen economy, the Indian government launched the National Green Hydrogen Mission on January 4, 2023.

Advanced Motor Fuels Statistics

With the heavy reliance on crude oil, India acknowledges the importance of alternative fuels that are better for the environment and cost-competitive with fossil fuels. This envisions the importance of alternative fuels in the Indian energy basket. The Indian government has been promoting and encouraging the use of advanced motor fuels in the transport sector, including the blending of biofuels — which are sustainable and have lower emissions than fossil fuels — in petrol, diesel, and natural gas.

Ethanol Blended Petrol Programme

With a view to decarbonizing the transport sector, the Indian government developed the “Roadmap for Ethanol Blending in India 2020–25,” providing guidance to meet the target of 20% blending of ethanol in petrol (E20) by ESY 2025–26. Following this initiative, the government has notified and allowed the oil marketing companies (OMCs) to sell E20, in accordance with the Bureau of Indian Standards (BIS) specification effective starting December 15, 2022. In line with its Ethanol Blending Roadmap, India launched E20 fuel in February 2023 and, by January 2025, almost all retail outlets across the country were selling E20 fuel. Under the EBP Programme, public sector OMCs achieved the highest-ever blending of ethanol in petrol (14.6%) in ESY 2023–24.

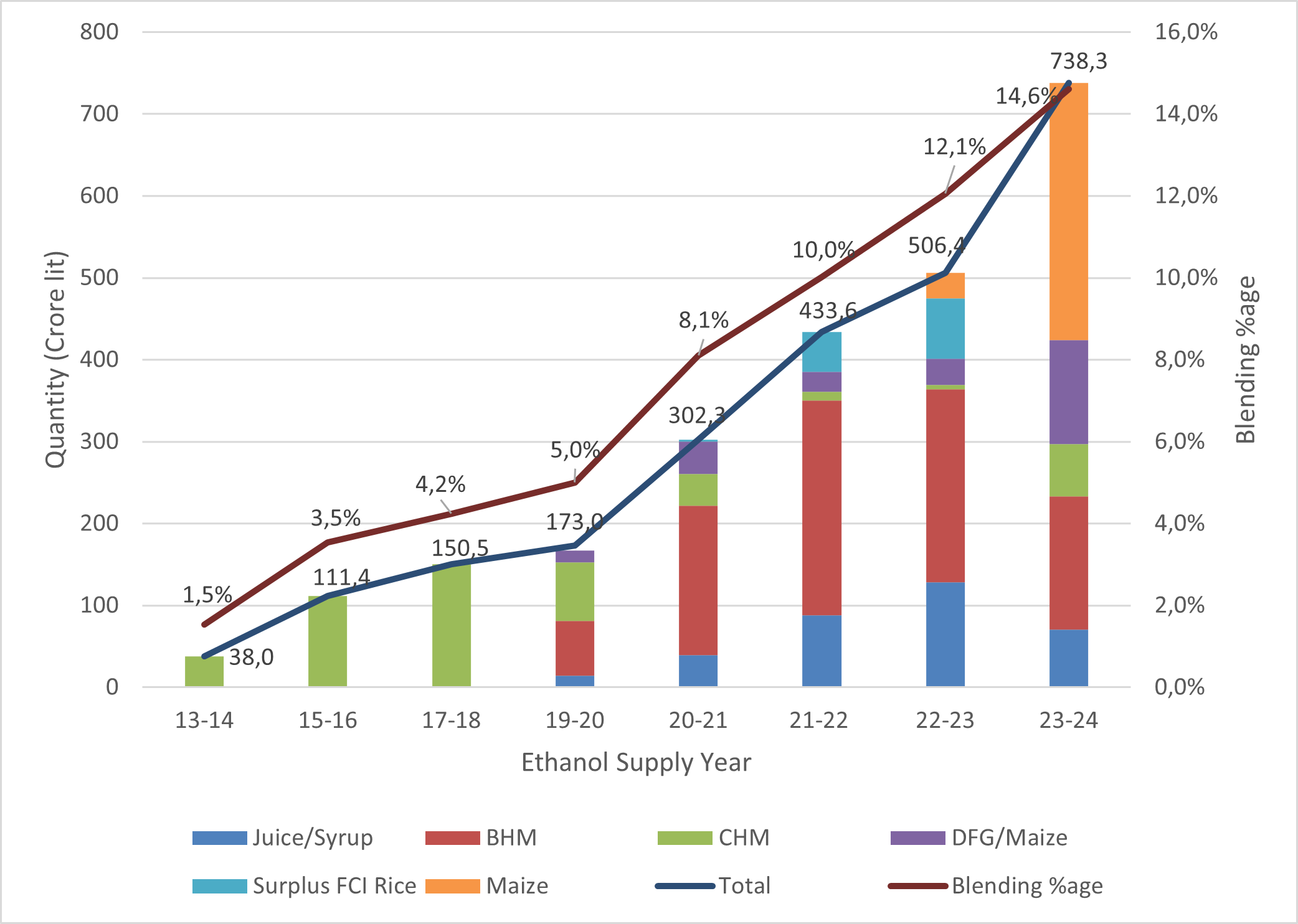

The Government of India has taken several steps to increase the production and use of ethanol, including permitting procurement of ethanol produced from damaged and surplus grains, sugar diversion, and non-food feedstocks. The government has adopted an administered price mechanism for ethanol procurement under the EBP Programme, provided incentives for use of maize as a feedstock by prioritizing its procurement and encouraging the establishment of dedicated ethanol plants (DEPs). OMCs have signed 232 long-term offtake agreements to add capacity of 7,920 million litres per annum. As of January 31, 2025, 86 DEPs have been commissioned with a design capacity of 5,360 million litres per year. Major developments in 2024 include constitution of a committee to develop a “Roadmap for Ethanol Blending beyond 2025,” that explores the potential of alternative feedstocks such as sweet sorghum, sugar beet, and cassava. Interventions over the last decade have facilitated a corresponding increase in ethanol blending percentage from 1.53% to 14.6%, making India the third-largest producer of ethanol in the world (see Table 1 and Figure 1). During ESY 2023–24, ethanol distillation capacity has increased substantially, reaching a level of 16.83 billion litres per year in December 2024.

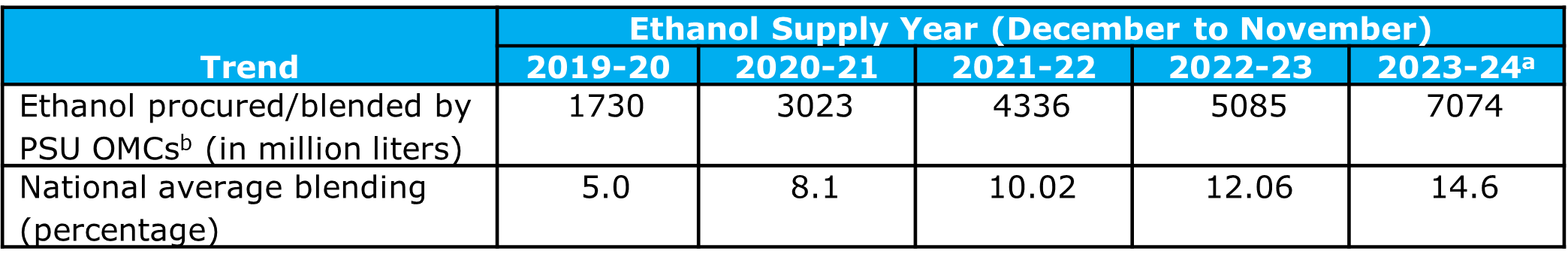

Table 1. Trends in Ethanol Procurement/Blending under EBP Program (Last 5 years)

a From ESY 2023–24 onwards, ESY will be considered from November to October

b Public sector undertaking (PSU) OMCs (i.e., Indian Oil Corporation Ltd. [IOCL], Bharat Petroleum Corporation Ltd. [BPCL], and Hindustan Petroleum Corporation Ltd. [HPCL].

BHM: B-heavy molasses, CHM: C-heavy molasses, DFG: Damaged Food Grain, FCI: Food Corporation of India

Figure 1. Trends in Ethanol Procurement/Blending under EBP Programme, including different feedstocks (ESY 2013–14 to 2023–24)

Advanced Biofuels

The Government of India launched “Pradhan Mantri JI-VAN (JaivIndhan-Vatavaran Anukoolfasalawashesh Nivaran) Yojana,” to provide financial assistance of approximately $250 million USD from 2018–19 to 2023–24 (now extended to 2028–29) to support commercial, as well as demonstration, projects for advanced biofuels. The amended scheme also includes advanced biofuels produced from lignocellulosic feedstocks (e.g., agricultural and forestry residues, industrial waste, synthesis [syn] gas, algae) in its scope. “Bolt on” plants and “brownfield projects” would also now be eligible to leverage their experience and improve their viability. Financial assistance of over $100 million US (908.25 crore INR) has been approved for six commercial and four demonstration 2G ethanol plants, including public and private sector companies. A 2G ethanol plant in Panipat was dedicated to the nation on World Biofuel Day (August 10, 2022). Projects at Bhatinda (Punjab), Bargarh (Odisha), and Numaligarh (Assam) are in advanced stages of construction and are likely to become operational in 2025.

Biodiesel and Sustainable Aviation Fuel

In June 2017, the government allowed the direct sale of biodiesel (B-100) for blending with high-speed diesel to all consumers, in accordance with specified blending limits and BIS standards. The government issued “Guidelines for Sale of Biodiesel for Blending with High-Speed Diesel for Transportation Purposes 2019” on May 1, 2019. Biodiesel procurement increased from 0.6 million litres in FY2021–22 (April 2021–March 2022) to 489.3 million litres in calendar year 2024.

Compressed Biogas

As part of an initiative under the National Policy on Biofuels 2018, the SATAT initiative was launched in October 2018 to promote the use of CBG along with natural gas. Under this initiative, oil and gas marketing companies (OGMCs) are inviting expressions of interest from potential investors and entrepreneurs to procure CBG for sale to automotive and commercial customers.

As of March 2025, 100 CBG plants with a total production capacity of around 700 metric tons (MT) per day have been commissioned; around 80 CBG plants are at various stages of construction. Sales of CBG have been initiated from more than 280 retail outlets. CBG is also being supplied to industrial customers, and CBG injection in the CGD network has started.

India’s Ministry of Petroleum and Natural Gas (MoP&NG) has issued guidelines for synchronization of CBG with the CGD network on a pan-India basis. Under the CBG-CGD synchronization scheme, CBG sales have been initiated in 58 geographical areas of the CGD network.

In India, a “whole of government” approach has been adopted, in which various departments work together to foster the production of CBG. The approach includes assured prices for off-take of CBG through long-term agreements with OGMCs; the Umbrella Scheme of the National Bio Energy Programme by the Ministry of New and Renewable Energy, which inter-alia provided central financial assistance to all kinds of CBG/biogas plants; additional central assistance for municipal solid-waste-based CBG projects under Swachh Bharat Mission Urban 2.0; the inclusion of bio-manure produced from CBG plants as fermented organic manure and liquid fermented organic manure under Fertilizer Control Order 1985; market development assistance to promote organic fertilizer produced from CBG projects by the Department of Fertilizers; the inclusion of CBG projects under the “White Category” by the Central Pollution Control Board on a case-to-case basis; the inclusion of CBG projects under Priority Sector Lending by RBI; loan products from various banks to finance CBG projects; among others.

In addition, during calendar year 2024, the Government has introduced a scheme to support CBG producers in procurement of biomass aggregation machinery (BAM); the scheme for development of pipeline infrastructure (DPI) for injection of CBG into the CGD network; and a phase-wise mandatory obligation for sale of CBG in the CNG (T) and PNG (D) segments of the CGD network. The CBG obligations will be 1%, 3%, and 4% of total CNG(T)/PNG(D) consumption for FYs 2025–26, 2026–27, and 2027–28, respectively. From FY 2028–2029, the CBG obligation will be 5%.

Green Hydrogen

The Indian Government approved the National Green Hydrogen Mission on January 4, 2023, with a total financial investment of approximately 2.5 billion USD (₹ 19,744 crore), including an outlay of about 2.2 billion USD (₹ 17,490 crore) in incentives for green hydrogen production and electrolyser manufacturing; the remainder will be used for pilot projects, research and development (R&D), and other mission components. India’s green hydrogen production capacity is likely to reach 5 million metric tons (MMT) per year by 2030, with the goals of reducing its fossil fuel imports of approximately 12 billion USD (₹ 1 lakh crore), achieving over 100 billion USD (₹ 8 lakh crore) in total investments, creating more than 600,000 jobs, and eliminating nearly 50 MMT per year of greenhouse gas emissions.

Various government-owned entities are taking steps to aid the ambitious National Green Hydrogen Mission by establishing green hydrogen projects. GAIL Ltd. has started India’s maiden project of blending hydrogen in the CGD grid —2% (by volume) of hydrogen is being blended into the CNG network and 8% (by volume) is being blended into the PNG network on a pilot basis.

MoP&NG has further directed the oil and gas PSUs to set up green hydrogen projects across the country. Oil and gas PSUs have planned for 900-KTPA Green Hydrogen Projects (engineering, procurement, and construction [EPC] and build, own, operate [BOO] modes) by 2030. 42 KTPA tenders have been floated by PSU refineries, which are likely to be awarded in the first half of 2025. In July 2024, HPCL commissioned the first-ever green hydrogen plant in an Indian refinery, with a capacity to produce 370 TPA of green hydrogen. GAIL India Limited also commissioned a 4.3-ton per day (TPD) proton exchange membrane (PEM) electrolyser-based plant in Vijaypur, Madhya Pradesh.

International Cooperation

Global Biofuel Alliance

The Global Biofuels Alliance (GBA) is a unique multi-stakeholder alliance, launched during India’s G20 presidency in September 2023 in the presence of the leaders from nine countries, as chair’s initiative. GBA aims to enhance global development and deployment of sustainable biofuels by bringing together the biggest consumers and producers.

Since its inception, GBA has received tremendous enthusiasm. Initially supported by 19 countries and 12 international organizations at launch, the alliance has since expanded its membership to include 28 countries and 12 international organizations, with a trajectory of ongoing growth and membership interest from more countries. In addition, the alliance has been receiving tremendous support from industry, both in India and abroad.

The alliance intends to expedite the global uptake of biofuels across a wide spectrum of stakeholders by facilitating capacity-building exercises across the value chain; providing technical support for national programs; and promoting policy lessons sharing and technology advances. GBA will also facilitate development, adoption, and implementation of internationally recognized standards, codes, sustainability principles, and regulations to incentivize biofuels adoption and trade. Finally, the alliance will act as a central repository of knowledge and an expert hub. GBA aims to serve as a catalytic platform, fostering global collaboration for the advancement and widespread adoption of biofuels.

GBA has also significantly enhanced its presence on the global pedestal by representation at international forums such as G20, International Forum on Sustainable Biofuels under the Italian G7 Presidency, COP28 (Dubai), COP29 (Baku), World Economic Forum (Switzerland), India Energy Week 2024 & 2025, and World Biogas Summit 2024 (UK).

India Energy Week (IEW) also gave fillip to the GBA. At IEW-25, GBA released a joint statement on sustainable biofuels, garnering endorsements from international organizations such as the International Energy Agency, Internation Energy Forum, World Economic Forum, World Biogas Association, and World Liquid Gas Association, reflecting India’s commitment to integrating sustainable alternatives into its energy mix. GBA also launched a whitepaper highlighting the role of non-grain-based biofuels in India’s energy transition.

International Partnership on Clean Energy Sector:

India and the United States continued to deepen their partnership through the Strategic Clean Energy Partnership (renamed as the Energy Security Partnership in February 2025). The September 2024 Ministerial Meeting marked significant advancements in clean energy collaboration.

India’s commitment to clean energy extends to 2G/3G biofuels, green hydrogen, and other emerging fuels. In June 2024, India signed a Letter of Intent with Italy for collaboration in green hydrogen and sustainable biofuels.

In September 2024, India and Brazil released a joint statement on sustainable aviation fuel for coordinated position at international forum to promote SAF.

Research and Demonstration Focus

The Centre for High Technology (CHT) — PSU OMC’s research and development unit under the MoP&NG, the Department of Biotechnology (DBT), and the Council of Scientific and Industrial Research – Indian Institute of Petroleum (CSIR-IIP), Dehradun — is working on a program to support R&D pertaining to bioenergy in India through various schemes, with major emphasis on advanced biofuels. The IOCL R&D center has developed indigenous technology for conversion of lignocellulosic biomass to 2G ethanol based on simultaneous saccharification and co-fermentation (SSCF) with onsite enzyme production. The demonstration-scale plant is installed at Panipat and is undergoing commissioning. Multiple demonstration-scale plants focused on new technologies to produce advanced ethanol are supported under PM JI-VAN Yojana and are under construction.

India has undertaken several initiatives to increase the use of hydrogen in its energy mix. IOCL has undertaken an ambitious R&D project under the aegis of MoP&NG at a cost of $35.8 million USD (₹ 297 crore). It is the first scientific project in India to address all aspects of the value chain of hydrogen-based mobility. Four demonstration-scale hydrogen production units producing 1 TPD will be set up. Of the four units, three will employ renewable sources (biomass gasification, reforming CBG, and solar photovoltaic [PV]-based electrolysis) to produce green hydrogen. To utilize green hydrogen produced from the demonstration plant, 15 fuel cell buses are being developed jointly with India’s leading heavy-duty vehicle manufacturer. IOCL will use these 15 indigenously manufactured/integrated hydrogen fuel cell buses to conduct a 20,000-km field trial on dedicated routes near Delhi’s National Capital Region and the Gujarat Refinery.

Studies are in advanced stages at the IOCL R&D center to install the world’s first pilot plant with a capacity of 10 kgCO2/day using gas fermentation technology. Anaerobic gas fermentation technology will convert CO2 into acetic acid, and aerobic fermentation technology will convert acetic acid into highly valuable omega-3 fatty acids (docosahexaenoic acid, or DHA) and biodiesel. This value chain makes the overall process economically feasible.

IOCL commissioned a third generation (3G) ethanol production plant to produce around 128 KL/day of ethanol using gas fermentation technology from off gases at Panipat Refinery.

In a significant development for decarbonizing of the aviation sector, India’s first commercial passenger flight using an indigenously produced SAF blend was successfully flown on May 19, 2023. In January 2024, Praj Industries Ltd.’s R&D unit established the first pilot project for producing ATF from alcohol near Pune in Pirangut, which was inaugurated by the Union Minister of India.

HPCL, in collaboration with a renowned institute, completed the assembly of an electrolyser for producing green hydrogen at a 5 Nm3/h capacity based on indigenously developed technology (alkaline). HPCL is planning to set up CBG plants with HP-RAMP (rapid acidification for methane production) technology and utilize the CBG in a steam methane reformer to produce about 21 KTPA green hydrogen. BPCL R&D is also working on long-term solutions for hydrogen storage and indigenous fuel cell systems, along with various academic institutes. BPCL R&D is scaling up indigenous alkaline electrolyser technology in collaboration with the Bhabha Atomic Research Centre (BARC). A study of the impact on the CGD network/NG pipeline resulting from various levels of hydrogen is in progress.

Outlook

The outlook for biofuels in India remains promising, considering the government’s promotion of biofuels and advanced biofuels as “environment friendly” fuels.

Ethanol blended by public sector OMCs reached 7,074 million liters, resulting in the highest-ever average blending percentage of (14.6%) in ESY 2023–24. With the rollout of the roadmap for E20 in India and the commitment shown by all stakeholders, the projected annual demand for ethanol is targeted at over 10 billion liters by ESY 2025–26. Since the government’s announcement on E20 fuel in February 2023, ethanol blending in petrol has seen remarkable growth, supported by numerous proactive measures taken by the Government. Since January 2025, ethanol blending has been consistently over 19.5%. Also, E100 fuels have been made available at more than 400 retail locations across the country. Further, biodiesel procurement surged to its highest-ever level of 489.3 million litres during 2024 (January 2024–December 2024).

The SATAT initiative will help India to reduce its dependence on fossil fuels, increase the share of gas in primary energy consumption, and integrate the vast retail network of companies with upcoming CBG projects. The government’s phased program to blend CBG with NG in the CGD sector will increase the use of CBG to 5% by 2028–29. Public and private sector companies have undertaken initiatives to adopt green hydrogen and announced commercial projects plans.

These highlighted initiatives have already begun to impact India’s biofuel industry. Major developments in the advanced biofuel sector — in terms of deployment in the transport sector, investments, project establishment, and enhanced R&D — are expected in the coming years.

Additional Information Sources

- 1- IEA Indian Oil Market Outlook to 2030

- 2- IEA India dataset-2024.

- 3- www.ppac.gov.in for data on fossil fuels production, consumption, import and export

- www.mopng.gov.in for data related to the petroleum sector

- https://mnre.gov.in/ for data related to green hydrogen

- https://www.siamindia.com for data on the automotive industry

- https://dbtindia.gov.in/ for R&D related data Roadmap for Ethanol Blending in India 2020–25

- India Energy Scenario for 2023–24 by BEE

- National Policy on Biofuels – 2018 (amended in 2022).